Market Verdict on Iron Ore:

• Neutral.

Macro:

• U.S. Federal increased interest rate by 25 bps to 5.00% – 5.25% area as previous expectation. However the conference didn’t mention “ a further interest hike”, which was read as federal would stop interest hike.

• IMF published “Economic Outlook for Asia and Pacific report”, which mentioned that China and India would drive up economic growth rate by 4.6% in the area, faster than 3.8% in 2022.

Iron Ore Key Indicators:

• Platts62 $106.20, -0.20, MTD $106.30. The market majorly moved along with macroeconomic sentiment during Chinese golden weeks, including the U.S. bankruptcies and interest hike. However, the price resilience was depending on the Chinese steel mills production cut in May.

SGX Iron Ore 62% Futures& Options Open Interest (May 3rd)

• Futures 80,149,000 tons(Increase 185,500 tons)

• Options 118,182,900 tons(Increase 1,733,800 tons)

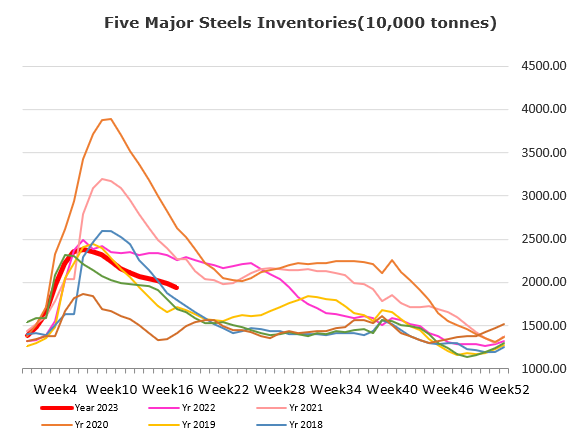

Steel Key Indicators:

• Tangshan average billet cost 3604 yuan/ton, down 50 yuan/ton on the week. Average steel production loss at 84 yuan/ton.

• Shagang Group, Zennith Group and Yonggang decreased the ex-factory rebar price by 100- 150 yuan in early May.

Coal Indicators:

• The FOB Australia market has a split view on the market, while waiting for Chinese buyers returning from Labour Day holiday.