Macro:

• BOE hiked interest rate by 25bps to 5.25%, which was the 14th interest hike since December 2021.

Iron Ore Key Indicators:

• Platts62 $103.75, -3.20, MTD $106.75. The seaborne trade was light this week. However Fe60.5% JMBF discount narrowed from $4.4 to $3.95. The steel margin recovery potentially support the resilient demand of iron ore in seaborne market.

• China 45 ports import iron ore inventories at 122.9 million tons, down 1.616 million tons. Daily evacuation 3.0075 million tons, down 129,800 tons on the week.

• Usiminas iron ore Q2 iron ore production 2.309 million tons, up 26.8% compared to Q1, down 1.4% on the year.

SGX Iron Ore 62% Futures& Options Open Interest (Aug 3rd)

• Futures 96,880,500 tons(Decrease 1,399,500 tons)

• Options 90,218,200 tons(Increase 1,454,000 tons)

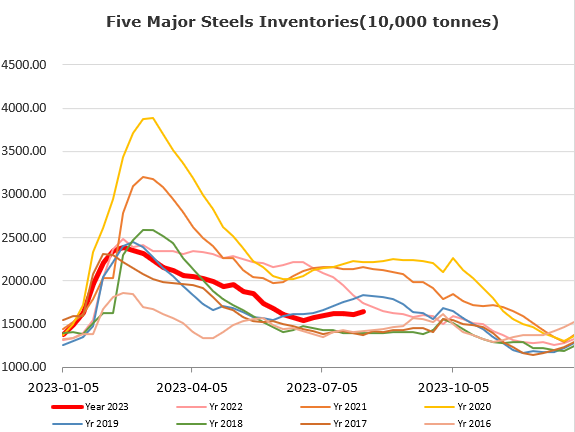

Steel Key Indicators:

• MySteel researched 247 steel mills utilisation rate 90.05%, up 0.23% on the week. Operation rate 83.36%, up 1.22% on the week.

Coal Indicators:

• The FOB Australia Index stablised after the $9 increase during past two trading days. There was enquires of PHCC from Indian end-users. U.S. seaborne coal stablised as well following the Australia market.