Market Verdict on Iron Ore:

• Neutral to bullish.

Macro:

• BOE increased interest rate by 75 bps to 3%, refreshed the highest interest rate since 2008.

• U.S. interest rate traders believed that the Federal would maintain the target interest rate at 5% during most time of 2023 to fight inflation.

Iron Ore Key Indicators:

• Platts62 $83.75, +0.70, MTD $82.32. Iron ore corrected massively last week, because of the sharp drop on steel margin and expected lower pig iron demand in the month ahead. NMHG was sold at $81.2, BRBF was sold at $82.2. The correction has already attracted bottom fishing traders. Thus, fixed-cargoes liquidity remain healthy.

SGX Iron Ore 62% Futures& Options Open Interest (Nov 3rd)

• Futures 94,233,000 tons(Increase 1,371,600 tons)

• Options 81,411,800 tons(Increase 295,000 tons)

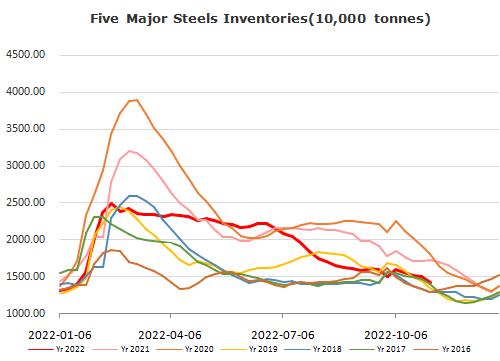

Steel Key Indicators:

• Chinese 40 EAFs cost at 3852 yuan/ton, down 192 yuan/ton. Average profit 1 yuan/ton, up 110 yuan/ton on the week.

Coal Indicators:

• FOB Australia coking coal improved by $4.25 to $315.75. A 40,000mt PMV Goonyella was traded at $315.