Market Verdict on Iron Ore:

• Neutral.

Macro:

• G7 member countries and Australia reached a consensus to set roof price of Russia export oil at $60/barrel.

• U.S. Labor Department statistics indicated that the November Non-Agricultural population reached 263,000 , beyond expected 200,000.

Iron Ore Key Indicators:

• Platts62 $107.30, +4.20, MTD $105.20. BRBF was traded at $107.9, which was the only under-valued high quality product. Import loss emerged again as the quick raise of seaborne iron ore. Chinese northern steel margin also squeezed to negative area. The market expect more PBF, MACF and JMBF trade during this week. The front spread dec-jan, jan-feb were considered still at low area given a high base number. Float trade was not active considering the uncertain time window covering Christmas and Chinese New Year. As a result, fixed price was indicated more spot demand.

SGX Iron Ore 62% Futures& Options Open Interest (Dec 2nd)

• Futures 95,855,900 tons(Decrease 59,800 tons)

• Options 78,212,300 tons(Increase 2,190,000 tons)

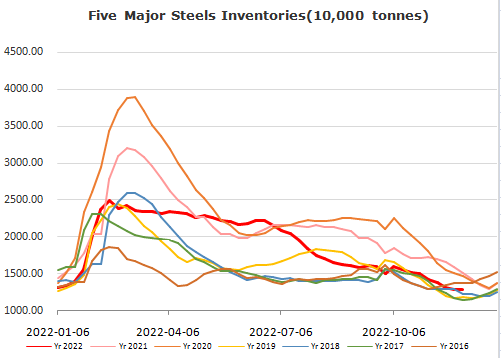

Steel Key Indicators:

• MySteel researched 247 steel mills blast furnace operation rate 75.61%, down 1.43% on the week, up 5.81% on the year. Blast furnace utilisation rate 82.62%, up 0.1% on the week, up 7.82% on the year.

Coal Indicators:

• Australia FOB PLV CC traded 30,000mt at $249.5, which is current index level. Currently market heard 75,000mt HCCA Branded Goonyella traded at $255 as the highest bid level for January laycan.