Verdict:

• Short-run Neutral to Bearish.

Macro:

• The U.S. ISM manufacturing PMI index recorded 46.7, which was lower than expected. It was below 50 for the thirteenth consecutive month, setting the longest record in more than 20 years.

• Tangshan and eight surrounding cities in Hebei launched Level II emergency alert to heavy pollution weather from 8:00a.m. on December 3rd.

Iron Ore Key Indicators:

• Platts62 $133.25, +1.20, MTD $133.25. There two laycans of PBF traded at IODEX January Index + $2.4 premium. The premium gradually improved from $2.2 to $2.4 during past week, indicating the demand shift from other brands of concentrates to PBF.

• FMG increased discounts on all mainstream products. The SSF discount widened from 5.75% to 6.5%. FBF discount was expanded from 2.0% to 3.5%. WPF expanded from 0% to 1.5%.

SGX Iron Ore 62% Futures& Options Open Interest (Dec 1st)

• Futures 120,543,000 tons(Increase 1,607,200 tons)

• Options 89,161,400 tons(Increase 392,100 tons)

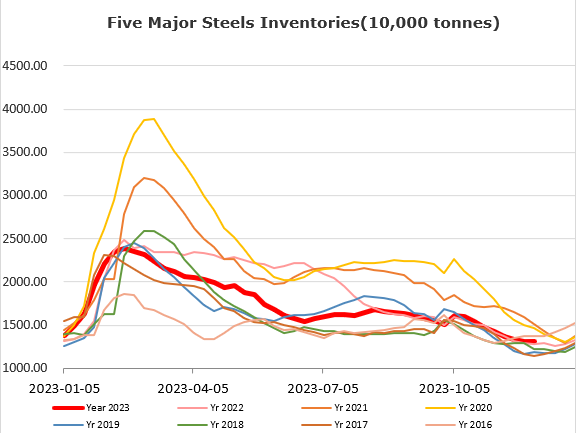

Steel Key Indicators:

• MySteel estimated 87 EAFs average utilisation 63.97%, up 0.53% on the week, up 10.99% on the year.

Coal Indicators:

• The FOB Australia coking coal price up for few days backed by the supply tight in Asian countries. Both Indian and Chinese buyers were looking for more prompt laycans in case unexpected disruption in supply because of safety check in China and wet season in east Australia.