Market Verdict on Iron Ore:

• Neutral to bullish.

Macro:

• U.S. May non-farm payrolls increased by 339,000, refreshed the biggest increase since January 2023, est. 195,000, last 294,000.

• After OPEC+ conference, Saudi Arab announced cut 1 million barrels/day in addition to the original cut in July. In a previous meeting, OPEC+ extended reduction to 2024.

Iron Ore Key Indicators:

• There was no index and seaborne trade last Friday because of the public holiday in Singapore. However, Chinese port iron ore rebounded 10 yuan/ton, equal to a $1.25 growth. Iron ore port inventories were lower than same period last year. In addition, mills inventories at 85.5-86 million tons were 20% lower on the year. However pig iron production was only 0.74% lower than last year. Thus, iron ore was in a tight supply mode compared to last June.

SGX Iron Ore 62% Futures& Options Open Interest (Jun 2nd)

• Futures 84,735,300 tons(Increase 815,400 tons)

• Options 92,373,100 tons(Decrease 47,000 tons)

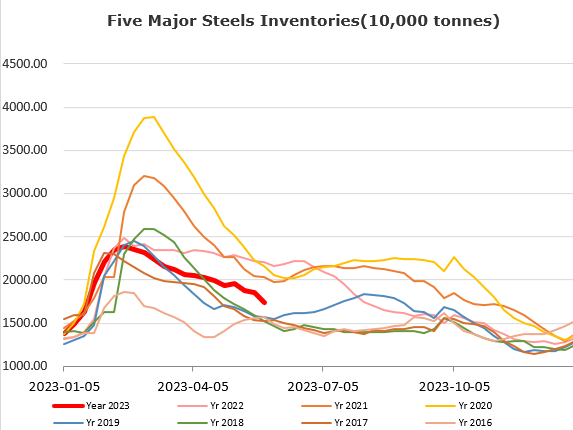

Steel Key Indicators:

• Tangshan steel mills received notice from environment department to stop some of blast furnace till the end of June. Mysteel estimated a 25,000 tons of pig iron reduction on daily basis.

Coal Indicators:

• China CFR coking coal price and FOB Australia price became inverted, because of the weakening pricing trend and demand in domestic Chinese market.