Market Verdict on Iron Ore:

• Neutral to Bearish.

Macro:

• The Manufacturing PMI in June reached 53.9, down 3.2 from last month. The index maintained above boom and bust line for consecutive six months.

Iron Ore Key Indicators:

• Platts62 $110.50, -0.05, MTD $110.53. The BRBF source became tight in the next few weeks. BRBF was sold at $113.4/mt yesterday. PBF supply decreased in the market, however mills were actively consider alternative plans, for example high and low grade blends, or discount sources as MACF and JMBF.

SGX Iron Ore 62% Futures& Options Open Interest (Jul 4th)

• Futures 91,425,900 tons(Increase 901,500 tons)

• Options 87,027,600 tons(Increase 128,000 tons)

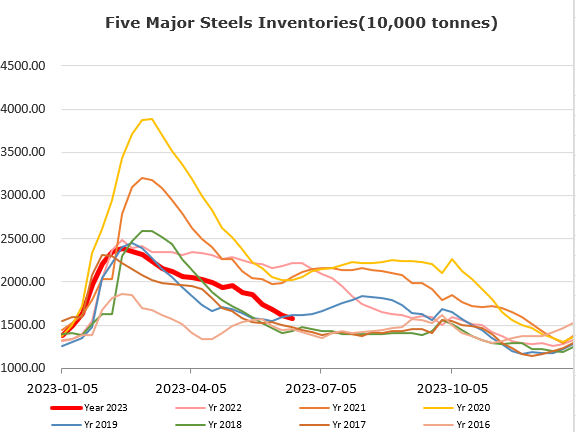

Steel Key Indicators:

• Japan exported 592,000 mt ferrous scrap, up 5.7% on the month. January to May total up 2.83 million tons, up 6.5% on the year.

Coal Indicators:

• There was 75,000mt Peak Downs PLV offered at $230 late delivered in August from last Friday. A bid was heard at $209 for HCCLV Peak Downs.