Verdict:

• Short-run Neutral.

Macro:

• US Beige Book showed stagnant and declining US economic activities. Price and wages rose modestly in recent weeks. Employers decreased hiring. The Atlantic Federal officer Bostic indicated that the high for long interest rate would hurt job market.

• Canada cut interest rate by 25 bps for the third time to 4.25%, fell into market expectation.

Iron Ore Key Indicators:

• Platts62 $92.25, -1.05, MTD $93.90. Iron ore market maintained bearish yesterday, billet started fast correction mode from this week. The long-expected downstream projects were delayed in September, which shift demand of steel to later weeks. There were resales of seaborne iron ore on ports from traders and end-users to seek liquidity. Iron ore restock was ongoing, which potentially slow down the correction of market.

SGX Iron Ore 62% Futures& Options Open Interest (Sep 4th)

• Futures 131,379,300 tons(Increase 89,400 tons)

• Options 154,875,100 tons(Increase 7,904,500 tons)

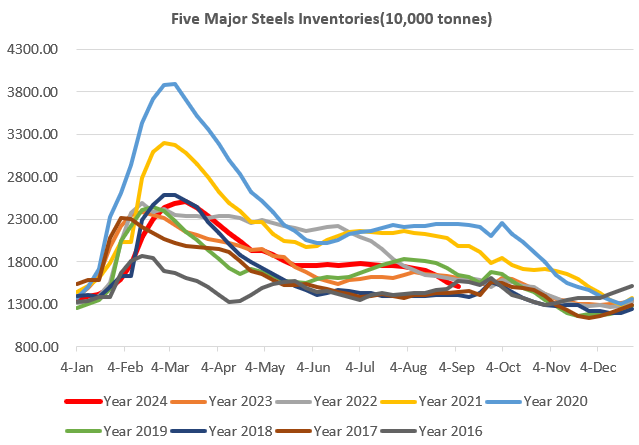

Steel Key Indicators:

• Tangshan average billet cost 3101 yuan/ton, down 59 yuan/ton, average loss at 281 yuan/ton.

Coking Coal and Coke Indicators:

• China biggest coal import land port Ganqimaodu, saw a 32.9% decrease on the trucks through customs compared to last month, because of heavy rain and low coal inventories in Mongolia.