Verdict:

• Short-run Neutral.

Macro:

• U.S. factory orders fell 3.6% on a monthly basis in October, which was larger than the expected 2.6% drop and was the lowest level since April 2020.

• The Passenger Car Association of China estimated that wholesale sales of new energy passenger vehicles in November will be 940,000 units, a year-on-year increase of 29% and a month-on-month increase of 6%. The estimated cumulative wholesale sales from January to November this year was 7.74 million units, a year-on-year increase of 35%.

Iron Ore Key Indicators:

• Platts62 $131.05, -2.20, MTD $132.15. The seaborne trade became active after the price level dropped. MACF discount widened from $1.65 to $1.85. Two laycans of JMBF were traded based on January Index + $2.65 and $2.7 respectively.

• Australia and Brazil total shipped 26.69 million tons of iron ore, up 160,000 tons on the week. China 45 iron ore ports arrivals at 24.74 million tons, down 420,000 tons on the week. Northern six ports iron ore arrivals at 11.81 million tons, down 3.077 million tons.

SGX Iron Ore 62% Futures& Options Open Interest (Dec 4th)

• Futures 121,115,500 tons(Increase 572,500 tons)

• Options 91,781,400 tons(Increase 2,620,000 tons)

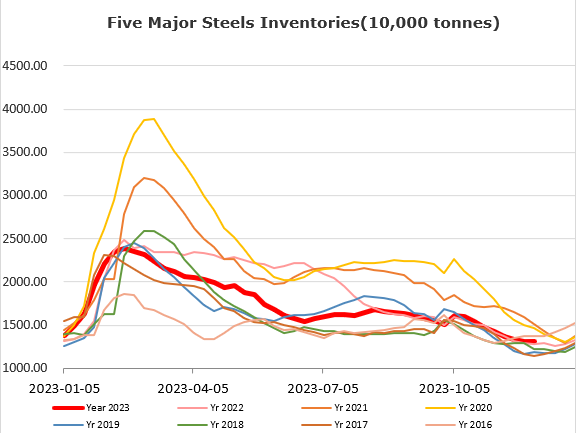

Steel Key Indicators:

• China 40 sample EAFs average steel cost 3955 yuan/ton, up 12 yuan/ton on the week. Average profit at 57 yuan/ton, down 12 yuan/ton on the week.

Coal Indicators:

• The China Coal Transport and Marketing Association released a forecast report stating that the coal production capacity are steadily released and coal imports remaining at a high level, it is expected that the country’s coal supply will be relatively sufficient.