Verdict:

• Short-run Bearish.

Macro:

• The OECD increased the global GDP growth rate from 2.7% to 2.9%.

• The IMF estimated that the growth rate of China in 2024 expected to increase by 4.6%.

Iron Ore Key Indicators:

• Platts62 $127.20, -0.80, MTD $129.33. Iron ore market suffered correction following the correction of Chinese equity market as well as taking gains of a half-year length growth. Iron ore demand was weaker to supply, which last from late December to January. Physical traders became cautious on the buying activities to avoid long holiday arrivals. The low margin potentially resist the further growth of iron ore after Chinese New Year.

• Australia and Brazil total shipped 23.25 million tons of iron ore, up 324,000 tons on the week start from January 29th.

SGX Iron Ore 62% Futures& Options Open Interest (Feb 5th)

• Futures 106,614,400 tons(Decrease 652,800 tons)

• Options 90,633,000 tons(Increase 2,071,500 tons)

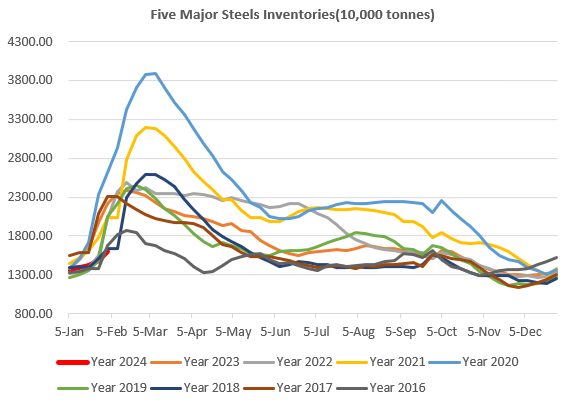

Steel Key Indicators:

• Germany Steel Association WVStahl statistic indicated that the crude steel production in 2023 reached the lowest since 2009, down 3.9% at 35.40 million tons from 2022. Germany is the biggest steelmaker in Europe.

Coal Indicators:

• The FOB coking coal market saw support from Indian market as the useable days of mills reduced from 70 days to 45 days. India buyers were currently short of prime coals. However the long holiday in China resisted CFR price of coking coal.