Market Verdict on Iron Ore:

• Neutral to bullish.

Macro

• China Auto Sales recover significantly in May. According to China Automobile Association statistics, China may vehicle sales 1.76 million units, up 49.59% from April, down 17.06% y-o-y. China January to May sales 9.45 million units, down 13.11% y-o-y.

• Russia announced that the country would increase grains export by 50 million tons.

Iron Ore Key Indicators:

• Platts62 $143.65, +0.00, MTD $140.09. Seaborne PBF gathered interests after import margin improved significantly. Iron ore seaborne trades significantly increased on previous two weeks. Rio Tinto sold quite a few laycans of Fe61% PBF on fixed price. BHP sold JMBF discount at $9-10. However steel mills margin was in 0 area, the marginal profit of some northern mills were even negative, which resist the big spike of current materials in mid-run level. Virtual steel margin was squeezed to extreme low area because iron ore increased faster than steel.

SGX Iron Ore 62% Futures& Options Open Interest (Jun 3rd)

• Futures 70,251,900 tons(Increase 8,500 tons)

• Options 71,605,500 tons(Increase 95,000 tons)

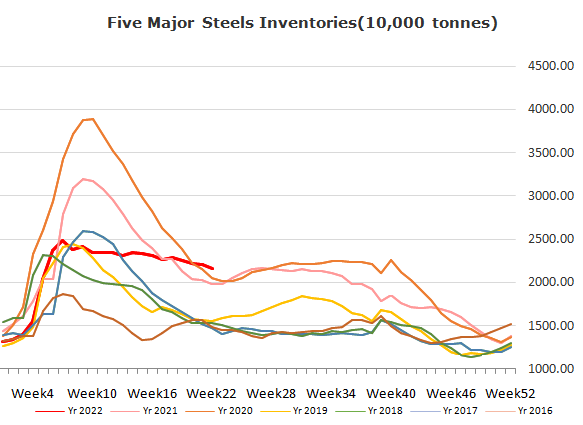

Steel Key Indicators

• The supply chain blockages in U.S. caused by Covid-19 pandemic continued as well as labor shortages exacerbated the delays in vessels and loading/unloading operation at port areas which prevent buyers from accepting attractive overseas offers.

Coal Indicators

• A lowest HCCA PLV bid in FOB Australia market was heard as low as $370, index was dragged down gradually as no real offers appear on the market. Russia semi-soft and semi-hard coals flooded in India coal market. In addition, China actively exported coke to India market, which lowered the prompt demand for FOB Australia met coals.

• Indonesia Energy Bureau announced to increase Thermal Coal benchmarket price HBA by $48.27(17%) to $323.91/mt, responding to the energy crisis.