Market Verdict on Iron Ore:

• Neutral.

Macro:

• U.S. Federal Reserve indicated divisions over interest rate decision in June meeting, however all committing to hike again later this month to fight against inflation.

• Eurozone PPI down 1.9% on the month est. down 1.8%, last down 3.2%. PPI down 1.% on the year, est. 1.3%, last up 1.0%.

Iron Ore Key Indicators:

• Platts62 $111.55, +1.05, MTD $110.87. JMBF traded at a $4.9 discount based on the August Index. MACF was traded at fixed price $105.9. The BRBF inquiries maintained strong because of the supply decrease in the next few weeks. PBF supply decreased in the market, however mills were actively consider alternative concentrates. Lump trade become active from late last week and this week because of the Tangshan production curb.

SGX Iron Ore 62% Futures& Options Open Interest (Jul 5th)

• Futures 92,008,900 tons(Increase 583,000 tons)

• Options 88,394,600 tons(Increase 1,367,000 tons)

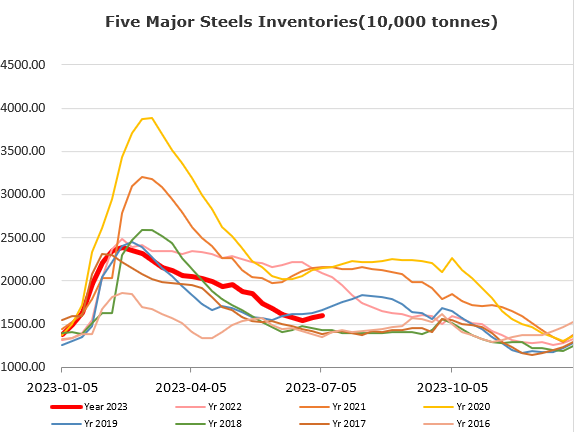

Steel Key Indicators:

• CISA member steel mills total produced 22.46 million tons of crude steel. Daily crude steel production at 2.246 million tons, down 0.74% from mid-June, up 7% on the year.

Coal Indicators:

• JFE reported a deal done at $221/mt for 40,000mt PLV German Creek, normalised to $224.5/mt FOB Australia. There was another PMV traded at $220.5/mt.