Verdict:

• Short-run Neutral.

Macro:

• The cooling on the job market intensified the correction on US bond, eyeing three-month low of 10-year US bond yield at 4.167%. US dollar index rebounded to 104, refreshed new high since November 22nd.

Iron Ore Key Indicators:

• Platts62 $131.40, +0.35, MTD $131.90. There was no trade from platform or MOC yesterday. The only trade was JMBF based on December average plus a $4 discount, traded by bilateral negotiation. The upcoming rainy weather in Brazil potentially impact the delivery in next few weeks.

• Tangshan and surrounding cities lifted air pollution alert from December 6th.

• Vale estimated iron ore production in 2023 at 315 million tons and predicted a 310 – 320 production target in 2024.

SGX Iron Ore 62% Futures& Options Open Interest (Dec 5th)

• Futures 121,536,500 tons(Increase 421,000 tons)

• Options 94,277,900 tons(Increase 2,496,500 tons)

Steel Key Indicators:

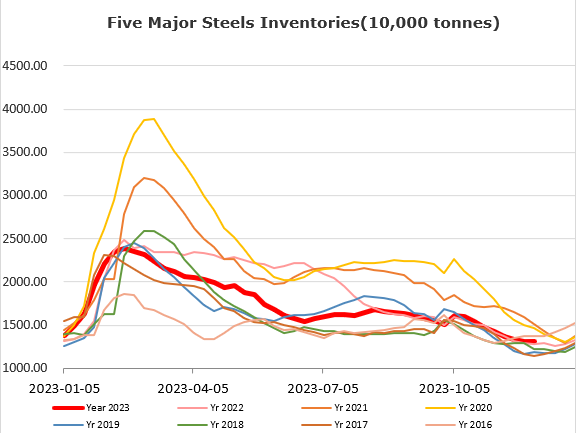

• CISA major steel enterprises produced 2.0161 million tons of crude steel per day, up 2.39% from mid-November, down 0.61% on the year. Steel inventories at 12.96 million tons, down 15.44% from mid-November, down 5.87% on the year.

Coal Indicators:

• The bid and offer were both muted in the FOB Australia coking coal market. The Australia Bureau of Meteorology cautioned a possibility of tropical cyclone near Queensland coast.