Verdict:

• Short-run Neutral.

Macro:

• In 2023, the domestic production of the top three coal producers worldwide all reached historic highs. China’s coal production reached 4.66 billion tons, a year-on-year increase of 2.9%. In 2023, India’s coal production reached 1.011 billion tons, a year-on-year increase of 10.9%. Indonesia’s coal production reached a historic high of 775.2 million tons.

Iron Ore Key Indicators:

• Platts62 $125.50, -1.70, MTD $128.38. Iron ore market saw stablisation before Chinese New Year. However the demand was frozen before holiday. Physical traders became cautious on the buying activities to avoid long holiday arrivals. Iron ore stocks were completed. The low margin potentially resists the further growth of iron ore after Chinese New Year.

SGX Iron Ore 62% Futures& Options Open Interest (Feb 6th)

• Futures 106,365,500 tons(Decrease 248,900 tons)

• Options 92,683,000 tons(Increase 2,050,000 tons)

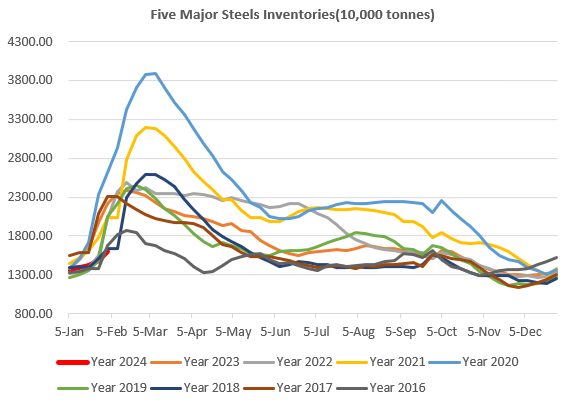

Steel Key Indicators:

• MySteel researched average rebar cost at 3992 yuan/ton in January, down 76 yuan/ton from December, loss at 162 yuan/ton, up by 39 yuan/ton on the month.

• MySteel researched construction enterprises statistics: the purchase of crude steel in January reached 5.75 million tons, down 23.1% from December, and expected a 30% decrease in February.

Coal Indicators:

• The FOB coking coal market corrected because of Asian buyers were looking for alternatives on prime coal market. The bid-offer spread reached as wide as $12-15/mt. The index of FOB Australia coking coal down $4.5, with sufficient offers on the market, however fail to attract enough buyers.