Market Verdict on Iron Ore:

• Neutral.

Macro

• Global May PMI 53.5%, up 0.3% from April, terminated the two consecutive decrease on monthly basis.

• BOFA predicted that ECB rate hike by 150 bps, including 50 bps increase in both July and September. Previous prediction was 100 bps hike.

Iron Ore Key Indicators:

• Platts62 $146.75, +3.10, MTD $142.65. Seaborne PBF gathered interests after import margin improved significantly. Iron ore seaborne trades significantly increased on previous two weeks. Rio Tinto sold quite a few laycans of Fe61% PBF on fixed price. BHP sold JMBF discount at $9-10. However steel mills margin was in 0 area, the marginal profit of some northern mills were even negative, which resist the big spike of current materials in mid-run level. Virtual steel margin was squeezed to extreme low area because iron ore increased faster than steel.

SGX Iron Ore 62% Futures& Options Open Interest (Jun 6th)

• Futures 73,248,700 tons(Increase 2,291,200 tons)

• Options 72,090,500 tons(Increase 485,000 tons)

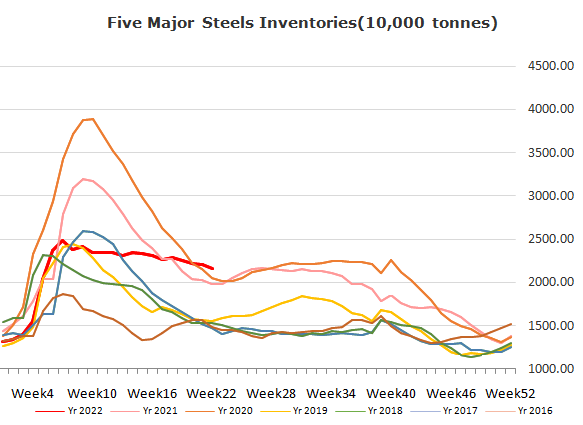

Steel Key Indicators

• Europe union indciated that the steel import quota expected to increase from 3 – 4% if passed the retrial.

Coal Indicators

• Indonesia Energy Bureau announced to increase Thermal Coal benchmarket price HBA by $48.27(17%) to $323.91/mt, responding to the energy crisis.