Verdict:

• Short-run Neutral to Bullish.

Macro:

• European central bank became the second bank in G7 to announce rate cuts following Canada. The EBC cut major interest rate by 25 bps. Thus, global equities and commodities saw a growth yesterday.

• The jobless files of US in last week reached 229,000, est. 220,000, last 219,000.

Iron Ore Key Indicators:

• Platts62 $109.10, +2.75, MTD $107.98. The landing margin of China import iron ore and the steel making profit both increased significantly during this week, which supported iron ore from further correction. In addition, the physical iron ore saw support on both price and volume after the drop on futures. The rate cuts from central banks became macro stimulus on commodities.

• China 45 ports iron ore inventories at 149.28 million tons, up 680,500 tons on the week. Daily evaluations at 3.1282 million tons, down 6,900 tons on the week.

SGX Iron Ore 62% Futures& Options Open Interest (Jun 6th)

• Futures 114,730,000 tons(Increase 282,200 tons)

• Options 159,836,900 tons(Increase 1,613,300 tons)

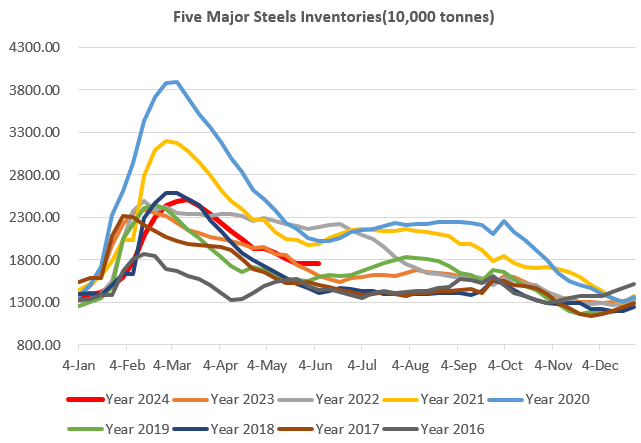

Steel Key Indicators:

• MySteel researched blast furnace utilisation rate at 88.14%, down 0.03% on the week, down 1.53% on the year. Daily pig iron production at 2.3575 million tons, down 800 tosn on the week, down 50,700 tons on the year.

Coal Indicators:

• Australia FOB coking coal market was quiet yesterday. Sources indicated that about 2 million tons of coking coal could be impacted in July and August because of a key rail line reduce its capacity.