Market Verdict on Iron Ore:

• Neutral.

Macro:

• The number of ADP employment in the US increased by 497,000 in June, the highest level since February last year, much higher than the expected 225,000 and far ahead of the expected 278,000. The yield of US two-year treasury bond bonds rose to 5.084%, the highest level since 2007. The 10-year period exceeded 4%, marking the first time since March. The Dow Jones index fell by 500 points after the data appeared, however recovery some loss by closing.

Iron Ore Key Indicators:

• Platts62 $111.85, +0.30, MTD $111.11.BHP sold JMBF at a $4.9 discount based on the August Index for the second day. Chinese steel mills were actively considering alternative concentrates for PBF and NHGF because of the lowered cost-efficiency. Thus, SSF rebounded 8 yuan/t on the ports. Lump trade become active in current two weeks because of the Tangshan production curb.

SGX Iron Ore 62% Futures& Options Open Interest (Jul 6th)

• Futures 92,610,000 tons(Increase 601,100 tons)

• Options 89,437,100 tons(Increase 1,042,500 tons)

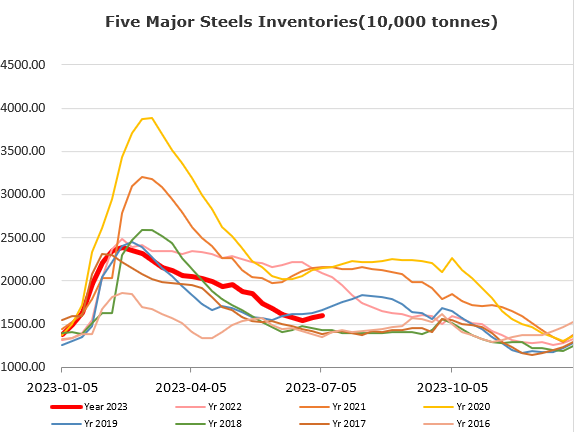

Steel Key Indicators:

• MySteel Researched 40 independent EAFs average cost at 3929 yuan/ton, average loss at 124 yuan/ton.

Coal Indicators:

• FOB Australia coking coal jumped up $7 on the day after stuck around $220-223 for two weeks, contributed by a PMV Goonyella trade at $235 for August laycan. The tightness of PMV supply supported the cargoes above $230.