Market Verdict on Iron Ore:

• Neutral.

Macro

• British new PM Elizabeth Truss said that she will prioritise economic growth, tackling energy crisis and improving access to health service.

• From January to August, China imported 723 million tons of iron ores, down 3.1% on the year. China imported 61.33 million tons of soybean, down 8.6% on the year. China imported 168 million coals, down 14.9% on the year.

Iron Ore Key Indicators:

• Platts62 $97.30, -0.70, MTD $96.48. The structure curve was still believed at narrow area since the medium over last 12 months was $0.57 for the next months and the following month contract, i.e. Oct22-Nov22. However the spread currently was in $0.3-0.35. PBF and NMHG regained popularity, with significantly improved volume in late half of August and discount/premium. Chinese northern ports has over 6 million tons of pellets, which hasn’t no change since June. However India mills were anxious about their pellets inventories on hand. The premium was hitting three-year-low, given the high export tax.

SGX Iron Ore 62% Futures& Options Open Interest (Sep 6th)

• Futures 94,105,700 tons(Increase 1,194,700 tons)

• Options 82,453,600 tons(Increase 845,000 tons)

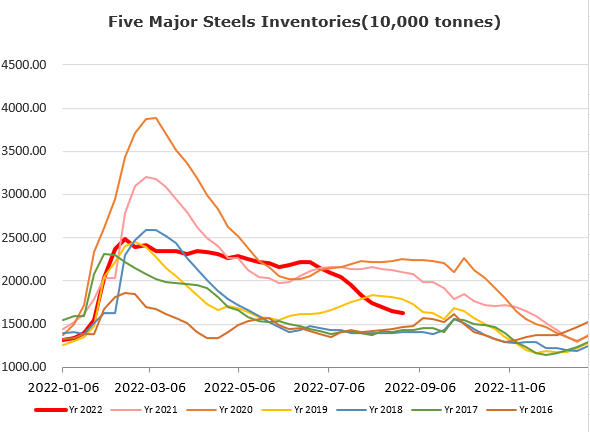

Steel Key Indicators

• The fire accident in POSCO impacted HRC lines. In addition, the typhoon landing caused some production halt.

Coal Indicators

• Australia FOB coking market was generally stable for current weeks, with 30,000mt Goonyella PMV traded at $272 for early October laycan.