Market Verdict on Iron Ore:

• Neutral.

Macro:

• Federal Reserve Chairman Jerome Powell said in his congressional testimony that he would further raise interest rates to achieve the 2% inflation target. The final interest rate level is higher than previously expected. If necessary, he would accelerate the pace of interest rate increase. Powell pointed out that although inflation has eased in recent months, the inflationary pressure is higher than expected at the last meeting.

• China Customs: China exported 12.19 million tons of steel in January-February 2023, a year-on-year increase of 49.0%. China imported 1.231 million tons of steel, down 44.2% year-on-year. China imported 19.4196 million tons of iron ore and concentrate, up 7.3% year on year. In January-February, China imported 60.642 million tons of coal and lignite, a year-on-year increase of 70.8%.

Iron Ore Key Indicators:

• Platts62 $128.00, +2.65, MTD $126.97. MB65-P62 spread maintained low at 1.11-1.12 during Q1, mills started to purchase some high grade as the high cost-effectiveness on the background of construction season in China. Moreover, IOCJ-BRBF reached a low area in history. On the otherside, low grade has narrowed discount for twice in 2023.

SGX Iron Ore 62% Futures& Options Open Interest (Mar 7th)

• Futures 99,564,400 tons(Increase 1,725,100 tons)

• Options 77,897,100 tons(Increase 1,175,000 tons)

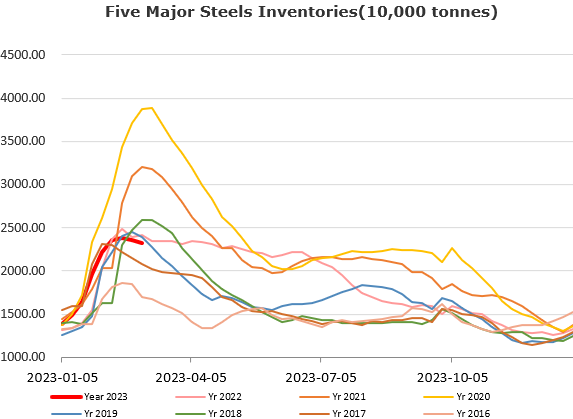

Steel Key Indicators:

• China sample EAFs scrap inventories at 4.32 million tons, inventory turnover in 10.2 days.

Coal Indicators:

• In Australia market, a bid heard at $360/mt FOB Australia for 40,000mt of globalCOAL HCCA Branded coal for April laycan, while an offer at $375/mt for HCCA Unbranded coal was heard for similar laycan.