Verdict:

• Short-run Neutral.

Macro:

• The employment growth in the US in March far exceeded expectations, and wages steadily increased, indicating a stable economic performance at the end of the first quarter, which may cause the Federal Reserve to delay the expected interest rate cut. The highly anticipated employment report on Friday also showed that the unemployment rate dropped to 3.8% in March. The number of non-farm payrolls has increased by 303,000, with an expected increase of 200,000.

Iron Ore Key Indicators:

• Platts62 $98.50, +0.20, MTD $100.16. The market saw active equiries before and after China Qingming holiday. However buyers dominate market left limited rooms for sellers. The over-weekends risk off sentiment on geo-tension in mid-east supported the morning growth on general commodities in particular for metals. Iron ore followed this growth in Asia morning.

SGX Iron Ore 62% Futures& Options Open Interest (Apr 5th)

• Futures 110,375,800 tons(Increase 35,400 tons)

• Options 117,318,800 tons(Increase 603,000 tons)

Steel Key Indicators:

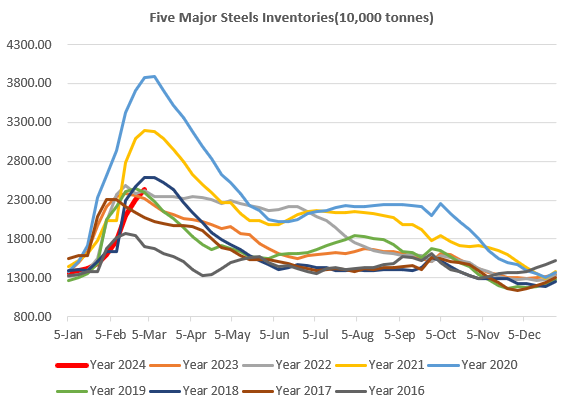

• CISA statistic indicated that late March member steel enterprises produced 2.12 million tons of steels, up 3.63% on the month, down 6.14% on the year.

• China FOB HRC export price down $10- 25 during past week.

Coal Indicators:

• The poor demand in Atlantic market for PLVs dragged down the index performance. Moreover, a 75,000mt laycan PLV was offering on globalCOAL for several days without seeing response given a continuous decrease on price levels. FOB Australia coking coal index down 8.59% in the first week of April.