Market Verdict on Iron Ore:

• Neutral to bullish.

Macro:

• The unemployment rate of U.S. has fallen to its lowest level in over 50 years, which is 3.4%. In April, non-farm employment increased by 253,000 files, but the job growth in February and March was 149,000 fewer than previously reported. The average hourly salary increase in April was also faster than in March. The resilient labor market may force the Federal Reserve to maintain high interest rates for a longer period to fight inflation.

Iron Ore Key Indicators:

• Platts62 $103.65, -0.40, MTD $105.08. The market sentiment recovered after the golden week in China. In addition, the strong steel margin in Chinese mills stimulate more mid-grade buying interest. Rio Tinto sold PBF, BHP sold MACF, Vale sold BRBF, with similar premium/discount level to late April.

SGX Iron Ore 62% Futures& Options Open Interest (May 5th)

• Futures 82,029,100 tons(Increase 276,300 tons)

• Options 98,494,900 tons(Increase 863,500 tons)

Steel Key Indicators:

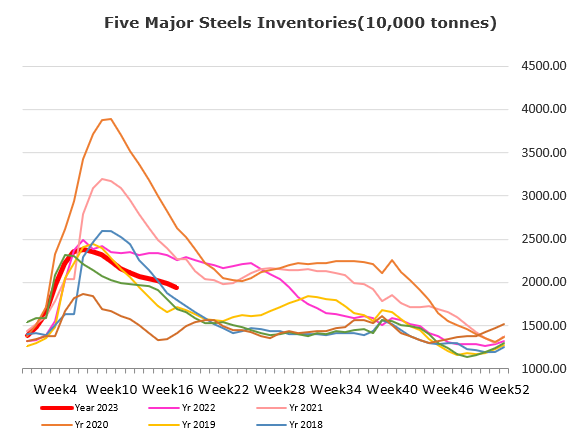

• CISA: Major steel mills daily crude steel output 2.21 million tons in late April, down 3.63% from mid-April. Steel inventories 18.11 million tons, down 2.32%.

• Some northern provinces in China started to make crude steel production target to maintain steel production same to or smaller than last year.

Coal Indicators:

• The FOB Australia PMV tradeable value arround $237.3 – 238.3/mt.

• The sixth round of coke price decrease in China hit ground, by 100 yuan/ton.