Market Verdict on Iron Ore:

• Neutral to bullish.

Macro:

• Many state banks in China announced to cut deposit rates in June 8th to bolster economy. ICBC, ABC and BOCC cut 15 bps on the three-year and five-year deposits respectively.

• OECD predicted that global economic growth rate slowed down to 2.7% in 2023, 2.9% in 2024.

Iron Ore Key Indicators:

• Platts62 $110.10, +1.20, MTD $108.59. The seaborne market saw a significant improvement in June as the stable pig iron demand and mills production. BHP sold Fe62.3% NHGF in $109.2/mt, market saw narrowing NHGF and PBF spread currently in both CNY or USD benchmark. In the secondary market, MACF and NHGF were both offered/traded at July Index + $1.5/mt, which potentially means an undervalue in NHGF relatively.

SGX Iron Ore 62% Futures& Options Open Interest (Jun 7th)

• Futures 91,669,600 tons(Increase 1,730,300 tons)

• Options 98,735,100 tons(Increase 4,017,500 tons)

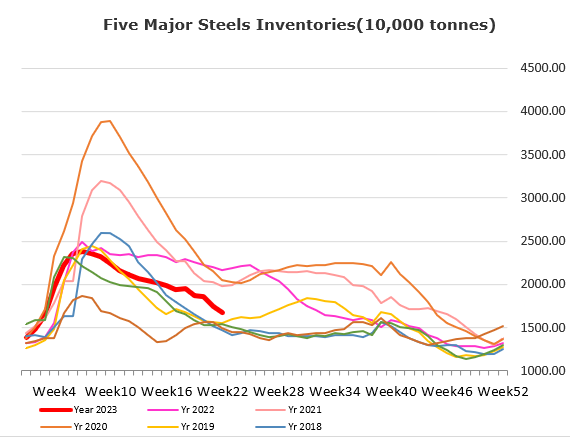

Steel Key Indicators:

• Tangshan major steel mills average pig iron cost 2537 yuan/ton. Average billet cost 3352 yuan/ton, down 11 yuan/ton on the week. Steel production margin at 88 yuan/ton, reversed from the production loss last week.

Coal Indicators:

• China CFR coking coal price and FOB Australia price became inverted, because of the weakening pricing trend and demand in domestic Chinese market.