Market Verdict on Iron Ore:

• Neutral to bullish.

Macro

• EU started to ban Russian coals shipping from August 10th.

• U.S. new added jobs in July created the biggest increase since February, which strengthened the expectation of 75 bps rate hike in September.

Iron Ore Key Indicators:

• Platts62 $106.95, +3.15, MTD $109.01. The term contract discounts for FMG in August widened in August, however market participants indicated that the current discounts were not great enough to attract buying interest. Mainstream seaborne cargoes including PBF, MACF, NMHG and JMBF were traded actively during the past two weeks. However the secondary market maintained quiet, indicating the demand market was yet to catch up with the fast increasing price on primary market.

• China imported 91.24 million tons of iron ore in July, up 2.275 million tons from June, up 3.1% on the year. Jan-Jul total imported 626.82 million tons of iron ore, down 3.4% on the year.

SGX Iron Ore 62% Futures& Options Open Interest (Aug 5th)

• Futures 92,114,500 tons(Increase 1,650,400 tons)

• Options 87,135,000 tons(Increase 1,625,000 tons)

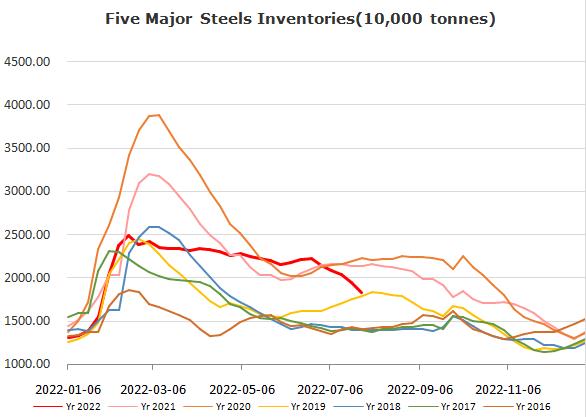

Steel Key Indicators

• Chinese sample blast furnace operation rate 72.7%, up 1.09% w-o-w. EAFs operation rate 56.34%, up 7.25% w-o-w.

• China Jan- Jul exported 40.07 million tons of steels, down 6.9% on the year.

Coal Indicators

• China imported 23.52 million tons of coals in July, up 4.54 million tons from June, down 22.1% on the year. Jan-Jul total imported 138.52 million tons of coals, down 6.9% y-o-y.