Verdict:

• Short-run Neutral to Bullish.

Macro:

• Recently, many regions in China have introduced policies to optimize housing provident fund. The loan amount for purchasing green construction or low-energy related building increased by 400,000 yuan to 1.6 million yuan. Guangzhou increases the maximum amount of provident fund loans.

Iron Ore Key Indicators:

• Platts62 $104.45, +5.95, MTD $100.88. The market saw active enquiries and trades after China holiday. There were two MACF trades at $98.8 and $100.7 respectively, the price level were the same after normalised the grades. The strong metals growth and weakened US dollar supported the growth of ferrous as well. In addition, the pig iron consumption were up last week.

SGX Iron Ore 62% Futures& Options Open Interest (Apr 8th)

• Futures 110,375,800 tons(Increase 35,400 tons)

• Options 117,318,800 tons(Increase 603,000 tons)

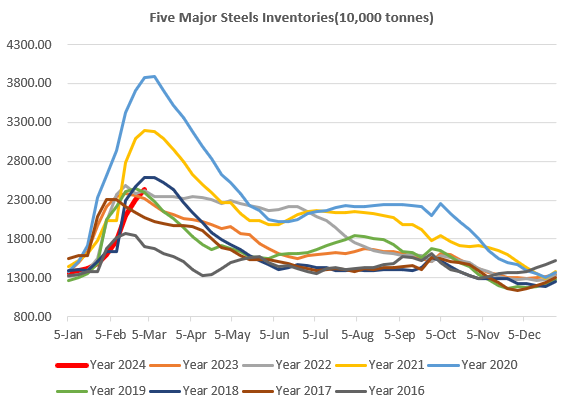

Steel Key Indicators:

• Asian Steel market extended the bearish sentiment in the first week of April. Hoa Phat, steel mill in Vietnam lowered SS400 price by $50 to $550/mt.

Coal Indicators:

• The poor demand in Atlantic market for PLVs dragged down the index performance. There was a May laycan cargo sold at $224 yesterday for 40,000mt PMV.