Market Verdict on Iron Ore:

• Neutral to bullish.

Macro:

• In the first four months, China imported 385 million tons of iron ore, an increase of 8.6% y-o-y, and the average import price (the same below) was 781.4 yuan per ton, a decrease of 4.6%. China imported 179 million tons of crude oil, an increase of 4.6%, at 4017.7 yuan per ton, a decrease of 8.9%. China imported 142 million tons of coal, an increase of 88.8%, at 897.5 yuan per ton, a decrease of 11.8%. China imported 13.587 million tons of refined oil increased by 68.6%, with a decrease of 19.1% at 4084.4 yuan per ton. During the same period, China imported natural gas reached 35.687 million tons, a decrease of 0.3% and an increase of 8% at 4151 yuan per ton. China imported soybeans amounted to 30.286 million tons, an increase of 6.8%, at 4559.8 yuan per ton, an increase of 14.1%.

Iron Ore Key Indicators:

• Platts62 $109.95, +6.30, MTD $106.05. The market sentiment recovered after the golden week in China. In addition, the strong steel margin in Chinese mills stimulate more mid-grade buying interest. Rio Tinto sold PBF, BHP sold MACF, Vale sold BRBF, with similar premium/discount level to late April.

• In the first week of May, 19 Australia and Brazil iron ore shipment at 26.15 million tons, up 365,000 tons on the week. 45 Chinese ports arrivals at 20.67 million tons, up 2.585 million tons on the week.

SGX Iron Ore 62% Futures& Options Open Interest (May 8th)

• Futures 83,822,700 tons(Increase 1,793,600 tons)

• Options 98,960,800 tons(Increase 465,900 tons)

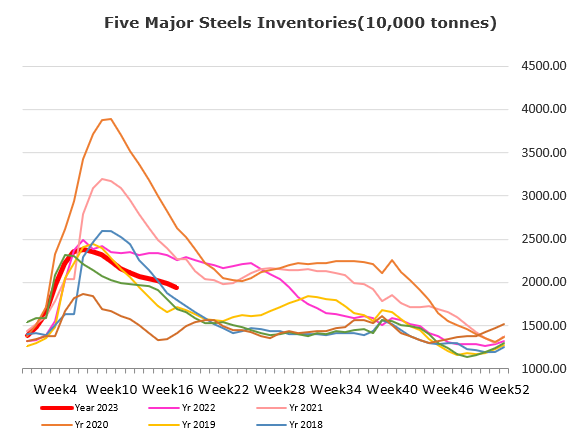

Steel Key Indicators:

• MySteel researched construction companies steel procurement at 6.9176 million tons in May, up 12% from April.

• Some northern provinces in China started to make crude steel production target to maintain steel production same to or smaller than last year. However most of mills indicated that they potentially start to control output in Q3 or Q4.

Coal Indicators:

• The FOB Australia PMV tradeable value arround $237.3 – 238.3