Verdict:

• Short-run Neutral.

Macro:

• China central bank PBOC announced to carry out a new tool: an afternoon window for reverse repo operations to help manage intra-day liquidity and ease market panic for potential funding tension.

Iron Ore Key Indicators:

• Platts62 $108.65, -1.85, MTD $111.21. Iron ore market entered watch and see mode. Buyers were waiting for the direction of market. Theoretically, the current pig iron consumption level should see more laycans during the week. Some traders expected bottom hunting buyers entrance when correction slow down. Australia and Brazil shipped 25.22 million tons of iron ore during past week, down 5.96 million tons on the week. China 45 ports iron ore arrivals at 27.87 million tons, up 3.17 million tons on the week. Northern six ports arrivals at 15.6 million tons, up 1.46 million tons on the week.

SGX Iron Ore 62% Futures& Options Open Interest (Jul 8th)

• Futures 106,115,700 tons(Increase 730,900 tons)

• Options 151,440,600 tons(Increase 76,000 tons)

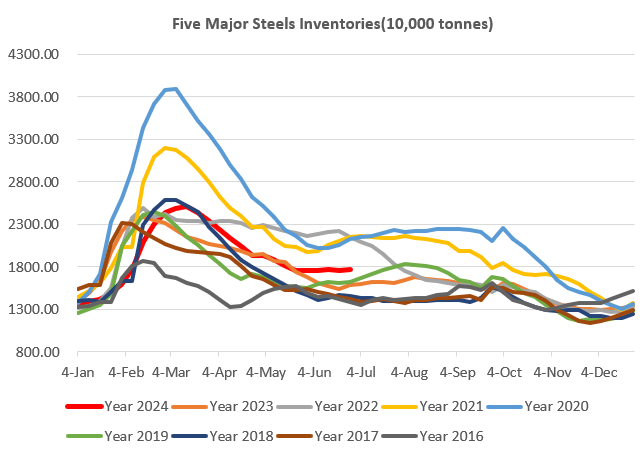

Steel Key Indicators:

• European Commission started to issue new steel import quota for the quarter from Jul 1st – Sep 30th. India and Turkey have used up quota for some certain steel types. Thus, some Asian exporters decided to clear export cargoes from next quarter.

Coal Indicators:

• The three major coal ports of Mongolia closed from July 11-15th because of public holiday.