Market Verdict on Iron Ore:

· Neutral.

Macro

· China National Bureau of Statistics: China October PMI 49.2, last 49.6, est. 49.7. The second month located in the contraction area.

· G20 countries drafted plan will take the maximum efforts to stop new build coal-based electricity power generating program.

Iron Ore Key Indicators:

· Platts 62%: $106.75 (-6.40) MTD $121.23. Iron ore last week traded both light on ports as well as on seaborne, as winter production curb impacted the marginal demand of iron ore. Mills operated at low efficiency decreased the structural demand on high grade iron ore and benchmark iron ore, which cased 62% Index weak. SGX spreads from Dec 21 – Apr 22 were flat, for example, Dec 21-Jan22, Jan22- Feb22 were stuck in $1.1- 1.25 area, which was a flat area historically. DCE Jan22 – May 22 also flattened to 6 yuan area. The flat structure to contango structure plus a stable price movement were a signal of rebound historically.

SGX Iron Ore 62% Futures& Options Open Interest (Oct 29th)

· Futures 61,380,400 tonnes(Decrease 14,633,300 tonnes)

· Options 59,719,500 tonnes(Decrease 27,966,000 tonnes)

Steel Key Indicators

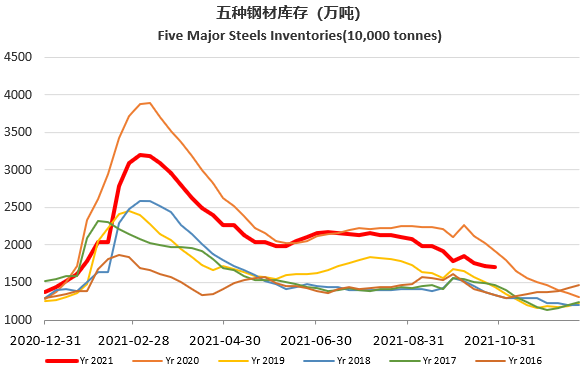

· Steelbank: construction steel urban area inventories 5.63 million tonnes, down 2.89% w-o-w. HRC urban area inventories 2.51 million tonnes, down 3.76%.

· Zhongtian Steel published early November steel ex-factory price down 400 yuan/tonne at 5500 yuan/tonne. Wire-rods down 400 yuan/tonne at 5850 yuan/tonne.

Coal Indicators

· China NDRC revealed that the power plant coal inventories would reach 110 million tonnes in next 3 days, useable days reach 20 days.