Market Verdict on Iron Ore:

• Neutral.

Macro

• China issued 1.82 trillion yuan local debts in Q1, more than doubled from the year 2021.

• Biden announced an unprecedented oil reserve release plan, about 1 million barrels of oil/day for six months from May, 180 million barrels in total. It is reported that the US government expects other countries to release oil reserves. OPEC + adhered to the original production increase plan, and the daily output increased by 432,000 barrels in May. In addition, OPEC + will no longer use the data of the International Energy Agency to evaluate the output performance of members.

Iron Ore Key Indicators:

• Platts62 $158.20, +5.25, MTD $150.50. Iron ore portside and seaborne both saw much higher offers on last Friday as trade sources indicated that mills are confident on the pandemic recovery in Tangshan, although Shanghai was still in a quiet mode with limited industry activities because the daily new added patients are refreshing higher numbers. Tangshan mills started to asking for raw material bids and preparing to increase the mills inventories step by step. Otherwise they will have to suspend the operation on blast furnace. MACF is the most popular mid-grade since the cost-effective to mills. Heavy discount fines and low grade are still major trades on seaborne market as well as portside market.

• Tangshan restart blast furnace of 9 cities previously controlled because of pandemic and areas accounted for 8.2 million tons of pig iron capacity.

• Australia big three miners C1 cost at $25/ton, other mid-small miners at $59/ton.

• FMG April Discount SSF 31%(March 38%), BF 21%(March24%).

• MySteel 45 ports iron ore inventories at 153.89 million tonnes, down 1.29 million tonnes w-o-w. Daily evacuation 2.69 million tonnes, up 49,800 tonnes w-o-w. Australia iron ore 74.36 million tonnes, down 25,700 tonnes w-o-w. Brazil iron ore 50.67 million tonnes, down 874,000 tonnes w-o-w. 118 ships at ports, down 9 w-o-w.

SGX Iron Ore 62% Futures& Options Open Interest (Mar 31st)

• Futures 77,065,800 tonnes(Decrease 14,921,900 tonnes)

• Options 77,259,000 tonnes(Decrease 14,444,800 tonnes)

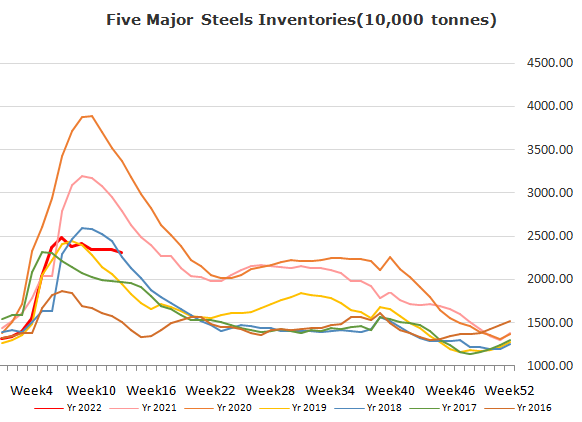

Steel Key Indicators

• China HRC offered at $1300 CIF in European market this week. India offered at $1250 – 1400 CFR. India offered down after Chinese flat steel entering European market.

Coal Indicators

• The interests of hard coking coal were majorly from ex-China areas. However the Australia FOB coking coal and CFR China coking coal spread has narrowed from $220 to $71.75 during the second half of March.