Market Verdict on Iron Ore:

· Iron ore short-run neutral.

Macro

· National Bureau of Statistics: in June, the commodity price index fell from a high level. Recently, a series of policies of “increase supply and stabilizing price” have been effective, and the rapid rise of manufacturing prices has been controlled. The ex-factory commodity price index of most industries had fallen, among which the ferrous metal smelting and rolling processing industry, non-ferrous metal smelting and rolling processing industry fell to the contraction range.

Iron Ore Key Indicators:

· Platts62 $218.40, +4.30, MTD $214.55。

· Rio Tinto ports overhaul ended, PB supply expected to increase in next few weeks. The demand of iron ore potentially rebound after the 100 year anniversary of China Party, when some mills started to increase utilisation rate and stock some iron ores.

SGX Iron Ore 62% Futures& Options Open Interest (Jun 30th)

· Futures 72,557,700 tonnes(Decrease 19,423,400 tonnes)

· Options 72,907,100 tonnes(Decrease 13,410,200 tonnes)

Steel Key Indicators

· Tangsong researched China northern steel mills pre-tax pig iron cost 3580 -3750 yuan/tonne, up 20-30 yuan/tonne. Average profit 184-357 yuan/tonne.

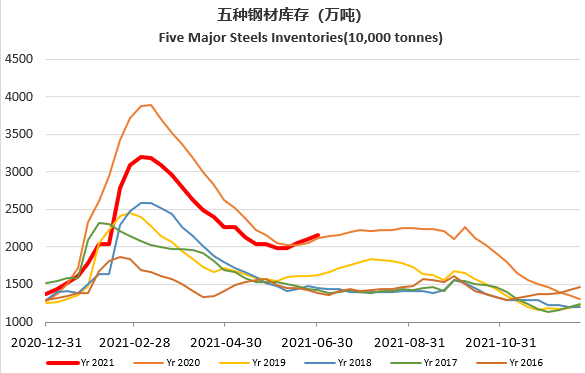

· MySteel Rebar Inventory: Rebar production 3.53 million tonnes, down 6.58% w-o-w. Mills inventory 3.56 million tonnes, up 1.06% w-o-w. Circulation inventory 7.88 million tonnes, up 3.19% w-o-w.

· Ganggu Construction Steel Inventory: production 5.42 million tonnes, down 305,500 tonnes w-o-w. Mills inventory 6.17 million tonnes, up 151,200 tonnes w-o-w. Circulation inventory 9.95 million tonnes, up 346,100 tonnes w-o-w.