Market Verdict on Iron Ore:

• Neutral.

Macro

• China May CPI up 2.1% y-o-y, est. 2.2%, last 2.1%. May PPI up 6.4%, est. 6.4, last 8%.

• China Customs statistic indicated that during Jan to May 2022, China imported 447 million tons of iron ores, down 5.1%. China imported 95.96 million tons of coals, down 13.6% y-o-y. China imported 4.98 million steels, down 18.3% y-o-y. China exported 25.91 million tons of steels, down 16.2% y-o-y.

• Russia has cut off the natural gas supply to countries which refused to make payments in rubles.

Iron Ore Key Indicators

• Platts62 $143.85, -3.05, MTD 144.09. Seaborne PBF gathered interests after import margin improved significantly. Iron ore seaborne trades significantly increased on previous two weeks. Rio Tinto sold quite a few laycans of Fe61% PBF on fixed price. BHP sold JMBF discount at $9-10. However steel mills margin was in 0 area, the marginal profit of some northern mills were even negative, which resist the big spike of current materials in mid-run level. Virtual steel margin was squeezed to extreme low area because iron ore increased faster than steel. As a result, buying interests from China end-users shift from mid-grade to low grade including Robe River Fines and Super Special Fines. There was higher offer on PBF at + $2.8 based on July Platts62 Index, however no bids showing on the market.

• MySteel 45 ports iron ore inventories at 128.45 million tons, down 3.88 million tons w-o-w. Daily evacuation 3.19 million tons, down 48,300 tons w-o-w. Australia iron ore 60.16 million tons, down 1.42 million tons w-o-w. Brazil iron ore 43.56 million tons, down 304,500 tons w-o-w.

SGX Iron Ore 62% Futures& Options Open Interest (Jun 9th)

• Futures 79,431,000 tons(Increase 1,942,700 tons)

• Options 76,422,000 tons(Increase 1,060,500 tons)

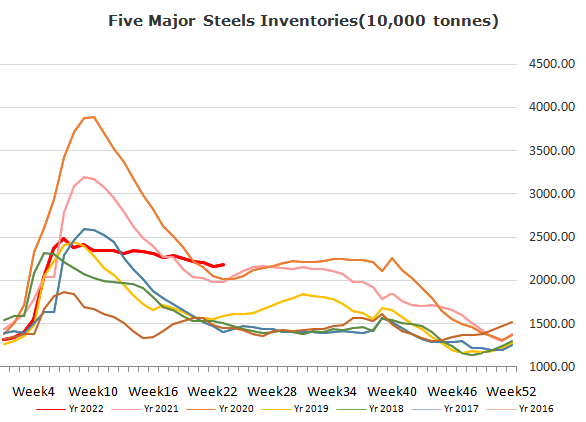

Steel Key Indicators

• MySteel surveyed 40 EAFs average steel billet cost 4894 yuan/ton, up 57 yuan/ton w-o-w. Average loss 103 yuan/ton, decrease 11 yuan/ton w-o-w.

Coal Indicators

• The end-users were not confident on global coking coal price during the massive collapse on global steel prices. HCCA unbranded offered at $410, the offer was $420, last week at $430. Sellers apparently do not have enough confidence to firm the offer at solid level.

• China Shanxi and Shandong province increased coke price by 100 yaun/ton, as northern hemisphere entering a peak season for coal consumption, plus Chinese demand support. European traders started to purchase coals again since EU will start to fully ban Russian coals from the second week in August.