Market Verdict on Iron Ore:

• Neutral to Bearish.

Macro:

• China June CPI unchanged on the year, down 0.2% from May. China June PPI down 5.4% on the year, down 0.8% from May.

• Initial jobless claim in U.S. for the week ended July 1st increased by 12,000 to 248,000, est. 245,000, indicating a gradual cooled labor market.

Iron Ore Key Indicators:

• Platts62 $109.45, -2.40, MTD $110.78. During last week, JMBF traded at a $4.9 discount based on the August Index for most of trading days. In the secondary market, PBF was traded at a $0.8 discount based on August Index. The major brands of mid-grade fines gradually lost competitiveness as the growing cost-efficiency on high grade and low grade concentrates. MB65- P62 difference improved from $11.71(Jun Average) to $13.34(July Average).

SGX Iron Ore 62% Futures& Options Open Interest (Jul 7th)

• Futures 94,467,600 tons(Increase 1,857,600 tons)

• Options 91,034,600 tons(Increase 1,597,500 tons)

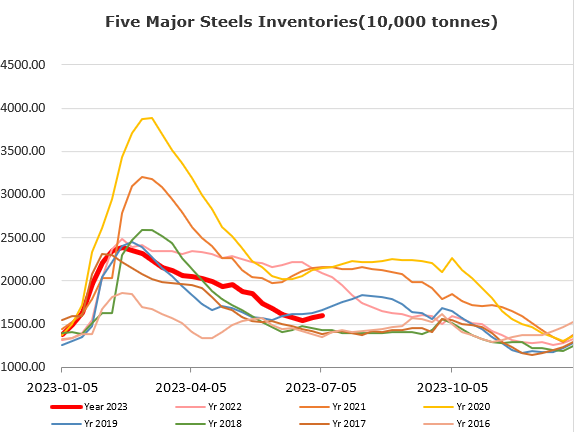

Steel Key Indicators:

• Mysteel blast furnace utilisation rate covering 247 steel mills at 92.11%, up 0.13% on the week, up 6.41% on the year. 87 EAFs utilisation rate at 51.04%, down 0.28% on the week, up 19.38% on the year.

Coal Indicators:

• The market edged down and reentered a stable mode after a $7 spike on last Thursday. End users indicated that the market was well-supplied with July – August cargoes of PHCC.