Market Verdict on Iron Ore:

· Iron ore short-run neutral.

Macro

· On June 9, the National Development of Reform Commission held a forum, proposing to closely track the trend of commodity prices, including price forecasting and early warning, further understanding the operation of relevant market entities, figure out the clues of illegal price increases, cooperate with relevant departments to further strengthen the linkage supervision of futures and physical markets, standardize price behavior, and maintain normal market system.

Iron Ore Key Indicators:

· Platts62 $213.50, +3.10, MTD $209.26. PBF traded at 1450 yuan/tonne on Shandong Port, increased by 40 yuan/tonne, which was the biggest single day increase over the current two weeks. However trade volume remain very cautious on ports. Seaborne traded actively on Yandi, FMG SSF, and lump, indicating some steel mills potentially prepare to lower cost on steel production by decreasing the mid-grade input.

SGX Iron Ore 62% Futures& Options Open Interest (Jun 9th)

· Futures 78,898,400 tonnes(Increase 761,900 tonnes)

· Options 77,477,300 tonnes(Increase 1,735,000 tonnes)

Steel Key Indicators

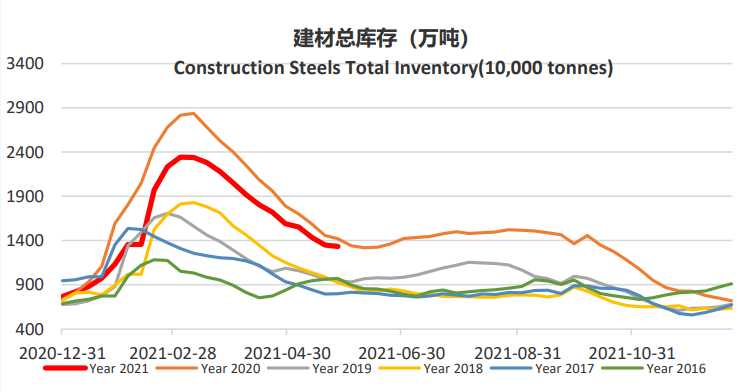

· MySteel Rebar Inventory: Rebar production 3.71 million tonnes, down 0.28% w-o-w. Mills inventory 3.14 million tonnes, up 1.79% w-o-w. Circulation inventory 7.34 million tonnes, down 0.03% w-o-w.

· Tangshan 10 sample steel mills pig iron before tax 3540 yuan/tonne, billet cost 4453 yuan/tonne, up 7 yuan/tonne w-o-w. Gross profit 507 yuan/tonne, down 47 yuan/tonne.

· China eastern area entered a high temperature and rainy season in June, construction projects slowed. Cements orders slowed down significantly during June.