Verdict:

• Short-run Neutral to Bullish.

Macro:

• Federal Reserve Chair Jerome Powell said he believed inflation was receding, yet to prove that price gains were sustainably slowing to the central bank’s 2% growth rate.

• China Regulative Body CSRC approved an increase in margin requirements for short selling. The biggest lending provider will suspend its business of lending securities to brokerages starting form July 11th.

Iron Ore Key Indicators:

• Platts62 $105.50, -4.10, MTD $110.29. Iron ore entered a quiet mode after a round of correction. The current rainy weather and extreme hot weather in different provinces resisted the pig iron consumption. The market was waiting for the China Planum next week.

SGX Iron Ore 62% Futures& Options Open Interest (Jul 10th)

• Futures 107,256,700 tons(Increase 384,500 tons)

• Options 152,900,100 tons(Increase 776,500 tons)

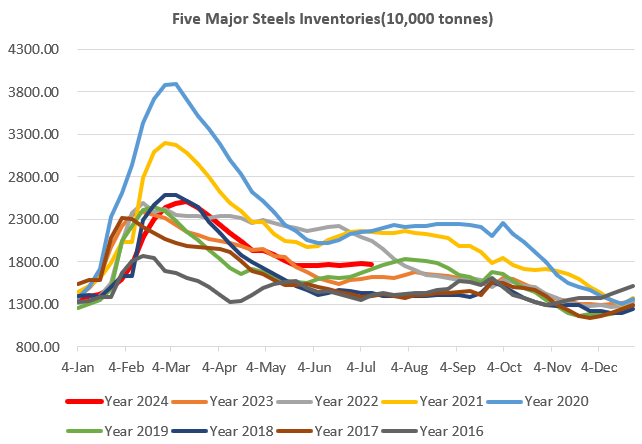

Steel Key Indicators:

• Zenith Group July EXW rebar down 70 yuan at 3500 yuan/ton, wire rods down 70 yuan at 3580 yuan/ton. An Steel and Ben Steel cut August rebar and wire rods price by 100 yuan/ton.

Coal Indicators:

• MySteel surveyed 523 China coking coal miners average utilisation rate at 90.2%, up 0.2% on the week.