Market Verdict on Iron Ore:

• Neutral to bullish.

Macro

• Chicago Federal official Charles Evans indicated that extra supply-chain interactions were not an issue when the unemployment rate was around the same low level in 2019, with less inflationary impact. Evans believed that if this steeper-than-usual Phillips curve is generating much of the higher inflation, then market should also expect this steeper curve to help bring inflation down relatively on the other side of the hill.

Iron Ore Key Indicators:

• Platts62 $98.75, +2.95, MTD $96.14. The trade activity in general eased off before and during golden weeks in China. Lump trade grew as the production restriction on sintering ores in Tanghshan in mid-late October. PBF and NMHG regained popularity, with significantly improved volume in late half of August, however the premium disappeared as the strong U.S. dollar versus Chinese yuan diminish the buying power of import cargoes.

• Tangshan estimated industrial activities control over Oct 14 – 22nd. Some steel mills indicated that they would be required to cut 50% production on sintering, with sintered ores useable days from 7- 10 days so far. Net, mills believed that the impact should be limited if no further extension on the length of cut.

SGX Iron Ore 62% Futures& Options Open Interest (Oct 7th)

• Futures 89,512,800 tons(Increase 2,609,200 tons)

• Options 68,766,200 tons(Increase 1,190,700 tons)

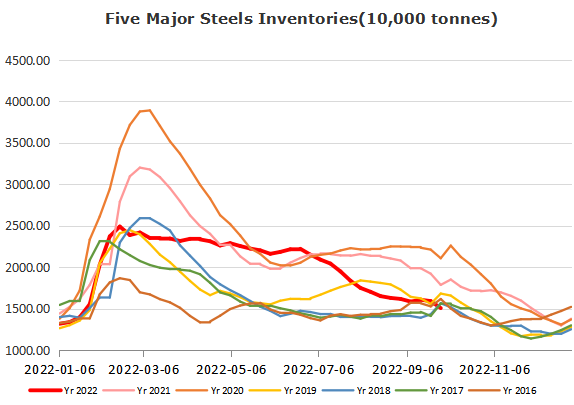

Steel Key Indicators

• Zenith mid-October ex-work rebar price at 4200 yuan, up 100 yuan from early October. Baowu Group ex-work Q235 price at 5723 yuan/ton for November, unchanged from October. Major products price unchanged in Baowu Group.

• Tangshan required the steel rolling mills to start maintenance from Oct 13- 15th.

Coal Indicators

• FOB Australia coking coal rebounded continuously as seeing many new trades. Index up $5.5 to $283.5 based on the fresh PLV trade reported done at $285 for 35,000mt cargoes from globalCOAL.

• Several cokery plants in China started the second round of increase on the offers, yet to receive any interests. Physical coke market was expected to maintain stable before the national conference. As a result, the offers have limited room currently.