Verdict:

• Short-run Neutral.

Macro:

• According to China NBS, China CPI in November down 0.5% on the year. PPI down 3% on the year. The decrease on both statistics are lower than expected.

• The US non-farm payroll increased by 199,000 in November, with an estimated increase of 183,000, compared to a previous increase of 150,000. The November unemployment rate was 3.7%, estimated at 3.9%, compared to the previous value of 3.9%.

Iron Ore Key Indicators:

• Platts62 $137.40, +1.35, MTD $133.80. The low CPI and PPI data offset the positive sentiment on China Politburo during weekends. However analysts indicated the low number on CPI was due to a low pork price and energy price. The adjusted number excluding these factors were flat to last month. The spread between 65% and 62% narrowed from $12.76 to $11.81 due to the low steel margin. There was no concentrate traded on negotiation or platform last Friday. The market obviously think the index was over-valued at that level.

SGX Iron Ore 62% Futures& Options Open Interest (Dec 8th)

• Futures 120,543,900 tons(Increase 476,000 tons)

• Options 97,849,700 tons(Increase 1,150,000 tons)

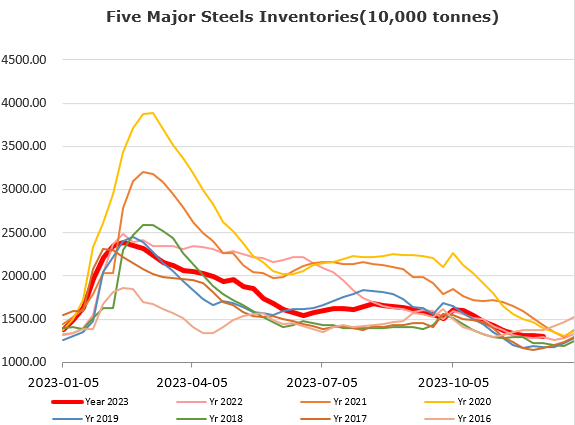

Steel Key Indicators:

• MySteel researched blast furnace produced rebar average loss at – 71 yuan/ton, improved by 65 yuan/ton from last month. HRC average loss at – 130 yuan/ton, improved by 29 yuan from last month.

Coal Indicators:

• The FOB Australia market saw higher offers because of the potential cyclone impact. However, BOM is predicting a weaker wind level on port areas in the following hours. There is yet any report of impact on loading or laycans so far.