Market Verdict on Iron Ore:

• Neutral.

Macro

• U.S. last week jobless claim reached 166,000, a new low since the year 1968. Est. 200,000, last 202,000.

• China CSRC(China Security Regulation Commission) and other departments jointly issued documents to encourage capital market investment and the listed housing company transformation into dynamic businesses.

Iron Ore Key Indicators:

• Platts62 $150.60, -4.05, MTD $157.42. Some northern China mills sources indicated they have completed the raw materials purchase before mid-April. Seaborne market iron ore prices fell as the pandemic uncertainties and period last longer than expected. Some Chinese cities started a very strict transportation policy even with few infected cases. Steel margin narrowed for consecutive weeks from early March which kept mills and traders in a watch-and-see mode. Long-term contracts were few than expected.

• MySteel 45 port previous week iron ore arrived 18.86 million tonnes, down 1.33 million tonnes w-o-w. Northern six ports arrivals at 8.67 million tonnes, down 377,000 tonnes w-o-w.

• MySteel Australia and Brazil iron ore total delivery at 17.31 million tonnes, down 3,000 tonnes w-o-w. Global iron ore delivery 29.05 million tonnes, up 1.61 million tonnes w-o-w.

SGX Iron Ore 62% Futures& Options Open Interest (Apr 11th)

• Futures 79,540,700 tonnes(Increase 691,700 tonnes)

• Options 82,659,000 tonnes(Increase 355,000 tonnes)

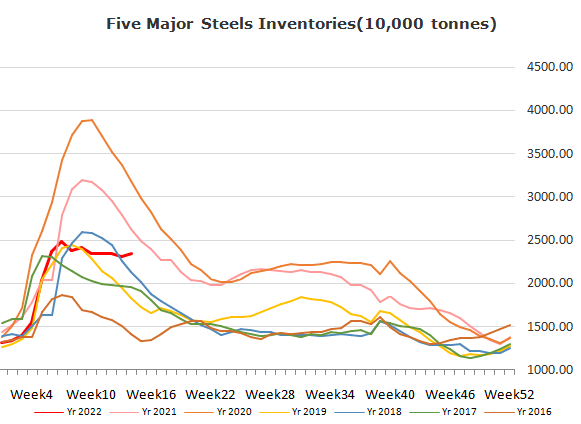

Steel Key Indicators

• Steelbank construction steel 8.13 million tonnes, down 2.38% w-o-w. HRC 3.02 million tonnes, up 3.05% w-o-w.

Coal Indicators

• The European Council adopt the fifth package of sanctions against Russia including imports ban on coal products announced on April 8th. However Russia started to increase coal supply to Asian countries.

• China PM Li Keqiang pointed out to guarantee the stable coal supply domestically and accelerate the advanced coal capacity production.