Verdict:

• Short-run Neutral.

Macro:

• The State Administration of Financial Supervision of China is researching to reduce the down payment of purchasing passenger cars and further optimise the pricing mechanism of new energy vehicles.

• US whitehouse expected a slow down on economy growth with stubborn inflation, and predicted CPI growth by 2.9% in 2024.

Iron Ore Key Indicators:

• Platts62 $108.40, -8.25, MTD $116.02. The lack of macro support and the production curb from some steel mills drag down the iron ore price. However iron ore potentially see stablisation as the recovery on steel margins. The seaborne market and port were both quiet after a huge drop on futures market.

• Australia and Brazil total shipped 25.22 million tons of iron ore from the week start from March 4th, down 221,000 tons from previous week. China 45 ports total arrived 20.247 million tons of iron ore during last week, down 3.523 million tons on the week .

SGX Iron Ore 62% Futures& Options Open Interest (Mar 11th)

• Futures 104,231,700 tons(Increase 3,138,200 tons)

• Options 110,813,600 tons(Increase 1,600,000 tons)

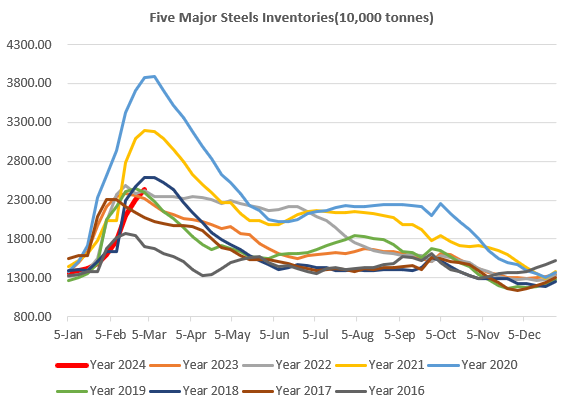

Steel Key Indicators:

• ShaSteel decreased rebar and wire rods ex-work price by 100 yuan/ton delivered in mid-March at 4020 yuan/ton and 4160 yuan/ton.

Coal Indicators:

• The FOB Australia coking coal dropped from $307/mt to $298/mt during two trading days, there was lack of real buyers above $300/mt, because of the oversupply on front laycans. The last trade was completed by JFE for 40,000mt PMV.