Market Verdict on Iron Ore:

• Neutral.

Macro:

• The global PMI in May was 48.3%, down 0.3% from April, created consecutive decrease for the previous three months. The index was lower than 50% for the past eight months. The index refreshed new low since June, 2020.

Iron Ore Key Indicators:

• Platts62 $116.65, +2.15, MTD $110.92. The seaborne market saw conservative trade activity during last Friday, with PBF traded in premium of $2.1 based on IODEX July in secondary market previously. CISA called a meeting to surveyed on the domestic iron ore projects, market read as a potential to increase supply in the following months.

SGX Iron Ore 62% Futures& Options Open Interest (Jun 9th)

• Futures 94,948,600 tons(Increase 1,732,800 tons)

• Options 101,941,100 tons(Increase 1,132,000 tons)

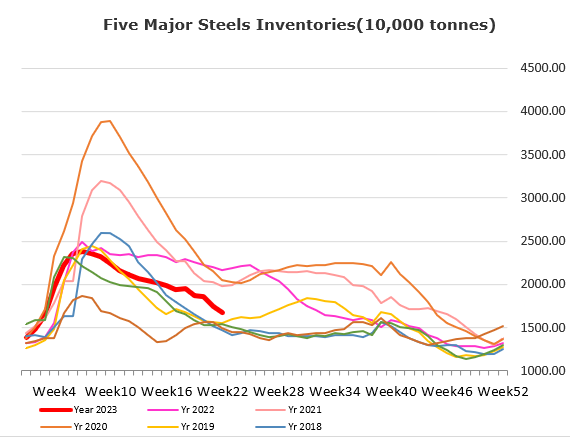

Steel Key Indicators:

• China Zenith Group and ShaSteel both increased ex-factory price for rebar and wire rods by 150 yuan/ton in mid-June delivery.

Coal Indicators:

• China CFR coking coal price and FOB Australia price became inverted, because of the weakening pricing trend and demand in domestic Chinese market.