Verdict:

• Short-run Neutral.

Macro:

• In June, the US CPI increased by 3% year-on-year, falling back to the lowest level since June last year, estimated 3.1%, last 3.3%. The June CPI decreased by 0.1% month on month, estimated 0.1%, last 0%. The core CPI in June increased by 3.3% year-on-year, falling to the lowest level since April 2021, estimated 3.4%, last 3.4%

• US jobless claims last week at 222,000, est. 235,000, last 238,000.

Iron Ore Key Indicators:

• Platts62 $108.15, +2.65, MTD $110.06. China 45 ports iron ore inventories at 149.89 million tons, up 2,300 tons on the week, up 24.94 million tons on the year. Daily evaluations at 3.0988 million tons, down 4,100 tons on the week, down 59,200 tons on the year. BHP traded two laycans of JMBF at August index and a discount of $7.69. Some buyers indicated the price level was overvalued. The PBF interest disappeared as negative landing margin.

SGX Iron Ore 62% Futures& Options Open Interest (Jul 11th)

• Futures 106,827,300 tons(Decrease 429,400 tons)

• Options 153,403,100 tons(Increase 503,000 tons)

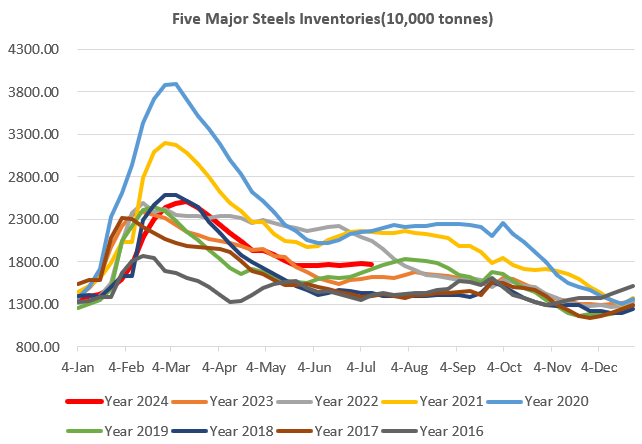

Steel Key Indicators:

• MySteel researched 247 steel mills average pig iron production at 2.38 million tons, down 10,300 tons on the week, down 60,900 tons on the year. The blast furnace utilisation rate at 88.70%, down 0.38% on the week, down 2.5% on the year.

Coal Indicators:

• The FOB Australia coking potentially maintain correction in future as lacking of trade and disparity among buyers and sellers. The shortage of August loading PMVs from Anglo American was fast replaced by other alternatives in the market.