Verdict:

• Short-run Neutral to bullish.

Macro:

• ECB predicted Euro Zone GDP growth by 0.8% in 2023 on the year, up 1.3% in 2024, lower than expected 1.1% and 1.6% respectively from last time.

Iron Ore Key Indicators:

• Platts62 $120.65, +3.85, MTD $118.65. Although the primary market of seaborne iron ore was quiet last week, the secondary market maintained active. The current China domestic iron ore became more cost-effective to seaborne.

SGX Iron Ore 62% Futures& Options Open Interest (Sep 11th)

• Futures 117,903,000 tons(Increase 2,771,300 tons)

• Options 106,482,900 tons(Increase 1,075,000 tons)

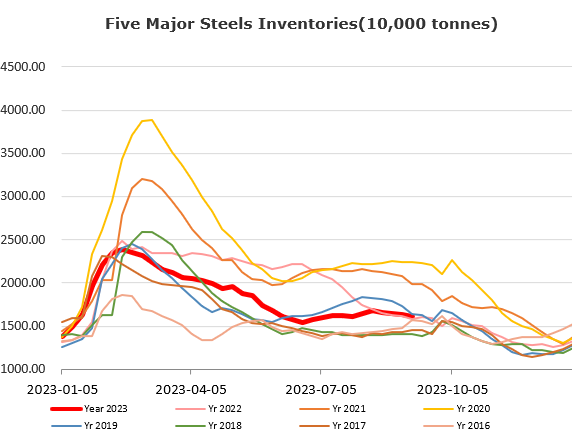

Steel Key Indicators:

• The ex-factory price of HRC delivered in October in Baowu Group up by 50 yuan compared to September. AnSteel increased HRC price by 100 yuan/ton delivered in October.

Coal Indicators:

• The FOB Australia market gained popularity in Aisa market, as the bid went higher. The PMV bids up from $280 – 288 in few hours, yet to receive any effective offer.