Market Verdict on Iron Ore:

• Neutral.

Macro

• China September social financing increased 3.53 trillion yuan, est. 2.75 trillion yuan, last 2.43 trillion yuan.

• IMF estimated global economy growth at 3.2%, unchanged from previous estimation at July. However IMF lowered the global growth rate to 2.7% from 2.9% in 2023.

Iron Ore Key Indicators:

• Platts62 $97.05, -1.70, MTD $96.27. The trade activity in general eased off before and during golden weeks in China. Lump trade grew as the production restriction on sintering ores in Tanghshan in mid-late October. PBF and NMHG regained popularity, with significantly improved volume in late half of August, however the premium disappeared as the strong U.S. dollar versus Chinese yuan diminish the buying power of import cargoes.

SGX Iron Ore 62% Futures& Options Open Interest (Oct 11th)

• Futures 91,401,400 tons(Increase 1,888,600 tons)

• Options 69,449,400 tons(Increase 683,200 tons)

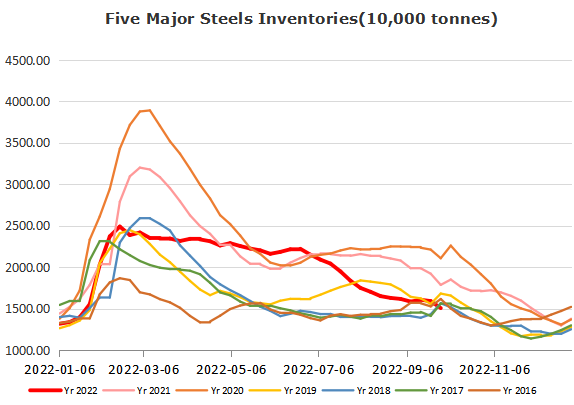

Steel Key Indicators

• MySteel researched 91 BF steel mills, rebar cost 3902 yuan/ton in September, down 42 yuan/ton, profit margin 21 yuan/ton. HRC average cost 4009 yuan/ton, donw 43 yuan/ton, profit margin – 70 yuan/ton.

Coal Indicators

• FOB Australia coking coal rebounded continuously as seeing many new trades. Index up $5.5 to $283.5 based on the fresh PLV trade reported done at $285 for 35,000mt cargoes from globalCOAL.

• Several cokery plants in China started the second round of increase on the offers, yet to receive any interests. Physical coke market was expected to maintain stable before the national conference. As a result, the offers have limited room currently.