Verdict:

• Short-run Neutral.

Macro:

• The China Automobile Association said that in November, automobile production and sales completed 3.093 million units and 2.97 million units respectively, an increase of 7% and 4.1% month-on-month, and a year-on-year increase of 29.4% and 27.4% respectively. The Association expected that automobile production and sales would hit record high in 2023.

Iron Ore Key Indicators:

• Platts62 $136.85, -0.55, MTD $134.24. As expected from yesterday, the spread between 65% and 62% narrowed from $11.81 to $11 due to the low physical steel margin. The buying preference growth for Brazil origin concerning the rainy weather. IOCJs and BRBFs trades grew significantly during the current two weeks. BRBF was traded at fixed price at $137.2. JMBF was traded with same discount during the current two weeks at $2.65 based on AM62% January Index.

• Australia and Brazil delivered 27.45 million tons of iron ore, up 763,000 tons on the week. China 45 ports iron ore arrivals at 24.54 million tons, down 207,000 tons on the week.

SGX Iron Ore 62% Futures& Options Open Interest (Dec 11th)

• Futures 120,301,200 tons(Decrease 242,700 tons)

• Options 98,702,200 tons(Increase 852,500 tons)

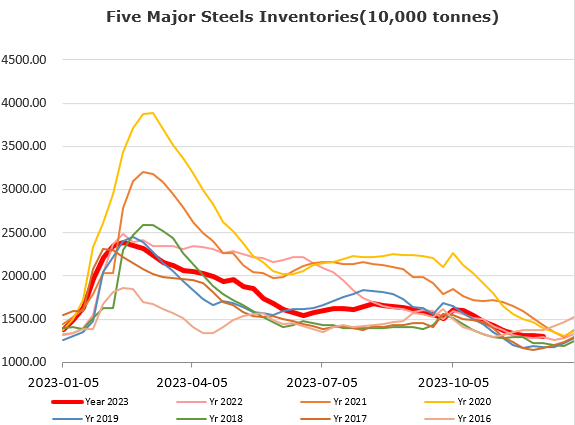

Steel Key Indicators:

• The biggest pig iron exporter over the world, Brazil exported 3.47 million tons of pig iron in the first eleven months of 2023, down 2% on the year.

Coal Indicators:

• The 3rd round of price increase by 100-110 yuan/ton on China domestic physical coke was accepted by mills. The strong domestic coke price was supported by snowy weather in north-western provinces.