Market Verdict on Iron Ore:

· Iron ore short-run neutral.

Macro

· China central bank PBOC decrease RRR by 0.5% on July 15th, an equivalent of 1 trillion yuan. However PBOC strategy commissioner said the RRR cut was neutralizing the maturity of MLF, the entire liquidity system was balanced and stable.

· A spokesman for the Ministry of Commerce answered a reporter’s question on the US Department of Commerce’s inclusion of 23 Chinese entities in the “list of entities” under export control. China firmly opposes it and will take necessary measures to resolutely safeguard China’s legitimate rights and interests.

Iron Ore Key Indicators:

· Platts 62%: $216.50 (-1.70) MTD $219.58.

SGX Iron Ore 62% Futures& Options Open Interest (Jul 9th)

· Futures 78,427,700 tonnes(Increase 981,600 tonnes)

· Options 78,822,900 tonnes(Increase 403,000 tonnes)

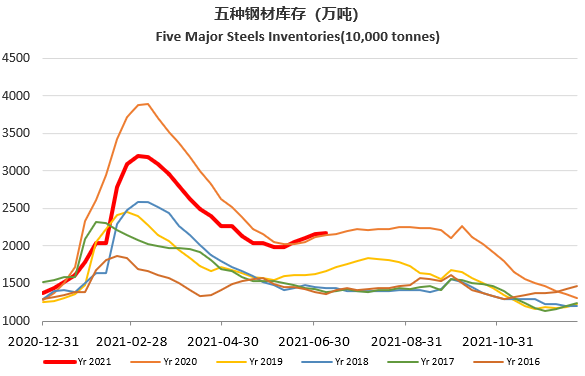

Steel Key Indicators

· MySteel Rebar Inventory: Rebar production 3.44 million tonnes, down 2.3% w-o-w. Mills inventory 3.43 million tonnes, down 3.7% w-o-w. Circulation inventory 8.13 million tonnes, up 3.1% w-o-w.

· U.S. last week ex-work HRC traded at $1800/short ton. The August orders were completely sold out.

· SHFE changed delivery rules on HRC and Rebar, to improve the quality and increase delivery efficiency.