Market Verdict on Iron Ore:

• Neutral.

Macro:

• U.S. March CPI up 5% on the year, lower than 5.2% expected, refreshed new low from May 2021, created a consecutive 9-month drop. However core CPI in March up from 5.5% to 5.6%.

• G7 Group indicated that the central banks in global countries would focus on the price stabilisation and increase resilience in financial systems.

Iron Ore Key Indicators:

• Platts62 $120.75, -1.25, MTD $120.85.The cyclone impact was believed to have limited impact on the supply, market cooled down following the fair trading and speculation control from Chinese regulators last week. Pig iron production was closed to a theoretical roof in China from late April or early May. Thus, physical traders initially cleared some stocks. The fixed trade potentially change into index based float cargoes in next few months given a fast drop on index. In addition, the weak import margin would resist the resilience from demand side.

SGX Iron Ore 62% Futures& Options Open Interest (Apr 12th)

• Futures 93,875,200 tons(Increase 1,418,600 tons)

• Options 101,120,500 tons(Increase 155,000 tons)

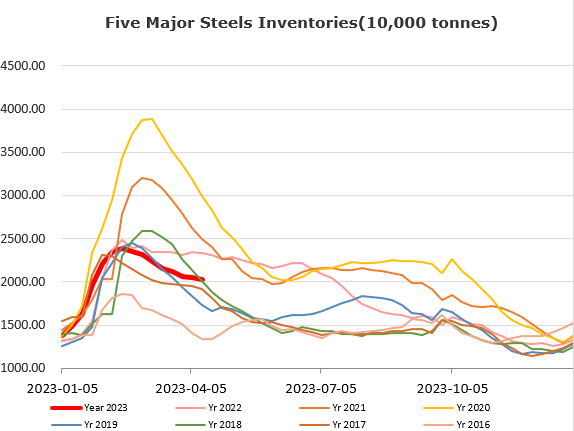

Steel Key Indicators:

• China construction steel trading volume was in 80- 85% during same period of last 2-3 years. Market failed to see an over-expected performance in H1 2023.

Coal Indicators:

• Australia FOB market saw ample supply on spot cargo, which potentially provide downward pressure on the market

• The Chinese traders revealed that the local mills are negotiating with miners on a 100-200 yuan/ton discount on coal product.