Market Verdict on Iron Ore:

• Neutral to bearish.

Macro

• Shanghai financial department statistic indicated that 9472 enterprises above designated scale resumption rate reached 96%, utilisation rate reached 69%, up 20% from the first week of June. Daily electronic consumption up 5.6% last week, which was 86% during same period over last year.

• U.S. FOMC will announce the rates decision in June 16th. U.S. CPI refreshed 40-year high, market has consensus on the 50 bp hike in June, however probability of 75 rates hike in July significantly increased.

Iron Ore Key Indicators:

• Platts62 $141.55, -2.30, MTD $143.77. Seaborne PBF gathered interests after import margin improved significantly. Iron ore seaborne trades significantly increased on previous two weeks. Rio Tinto sold quite a few laycans of Fe61% PBF on fixed price. BHP sold JMBF discount at $9-10. However steel mills margin was in 0 area, the marginal profit of some northern mills were even negative, which resist the big spike of current materials in mid-run level. Virtual steel margin was squeezed to extreme low area because iron ore increased faster than steel. As a result, buying interests from China end-users shift from mid-grade to low grade including Robe River Fines and Super Special Fines. There was higher offer on PBF at + $2.8 based on July Platts62 Index, however no bids showing on the market.

SGX Iron Ore 62% Futures& Options Open Interest (Jun 10th)

• Futures 80,774,400 tons(Increase 1,343,400 tons)

• Options 78,118,000 tons(Increase 1,696,000 tons)

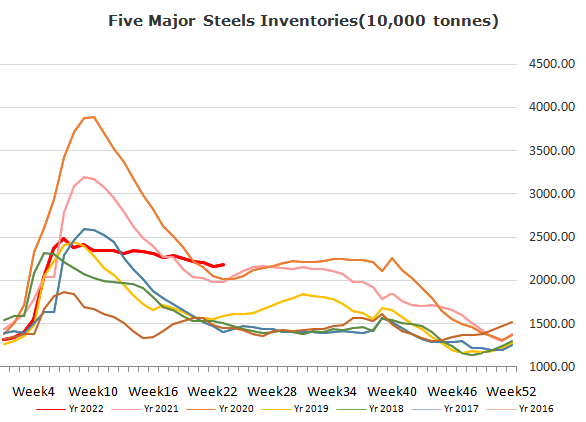

Steel Key Indicators

• MySteel surveyed 40 EAFs average steel billet cost 4894 yuan/ton, up 57 yuan/ton w-o-w. Average loss 103 yuan/ton, decrease 11 yuan/ton w-o-w.

Coal Indicators

• China Shanxi and Shandong province increased coke price by 100 yaun/ton, as northern hemisphere entering a peak season for coal consumption, plus Chinese demand support. European traders started to purchase coals again since EU will start to fully ban Russian coals from the second week in August.

• Australia FOB and CFR China PLV diverged further, CFR China current became $67.5 higher than Australia FOB, indicating a resilient Chinese demand came back to seaborne market after restricted for two months by the pandemic. The FOB used to be $80-90 higher than CFR in April.