Market Verdict on Iron Ore:

• Neutral.

Macro:

• Following the state-owned banks rates cut, twelve China’s key joint-stock banks cut deposit rates, ranged from 5 -15 bps.

• Jonathan Haskel, rate setter of BOE, said further increased in interest rate cannot be ruled out given a high inflation rate.

Iron Ore Key Indicators:

• Platts62 $112.40, -4.25, MTD $111.13. The seaborne market suddenly muted eying the correction in derivatives market. The changing hands in secondary market disappeared. In primary market, both discount of MACF and JMBF raised because of increasing supply in June and July. BHP sold JMBF based on July IODEX at discount of $4.2.

SGX Iron Ore 62% Futures& Options Open Interest (Jun 12th)

• Futures 94,933,900 tons(Decrease 14,700 tons)

• Options 104,434,100 tons(Increase 2,493,000 tons)

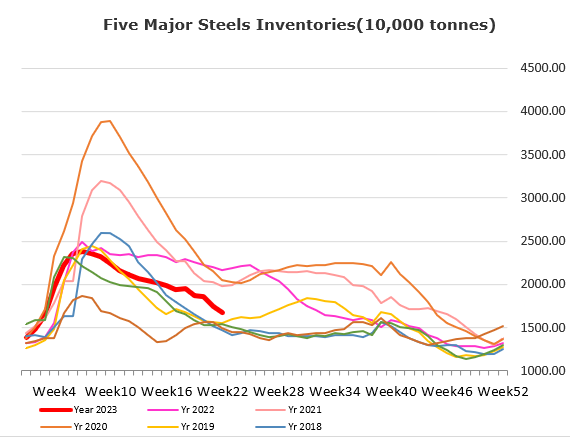

Steel Key Indicators:

• The rebar and wire rods price both increased following the ex-factory price raise in eastern provinces. However the daily construction trading volume dropped by 30% from the high in May.

Coal Indicators:

• The ex-China demand was unsustainable for FOB Australia coking coal, however India demand was resilient. There was PMV tender from Indian end-user for 50,000mt and July laycan.