Verdict:

• Short-run Neutral to Bullish.

Macro:

• US Federal maintained unchanged for interest rate at 5.25-5.5%, fell into market expectations. However the recent matrix indicated that the probability of interest cut dropped from 3 times to 1 time in 2024.

• On June 12th, the European Commission issued a statement proposing to impose a temporary countervailing duty on electric vehicles imported from China starting from July 4th, with a tax rate ranging from 17.4% to 38.1%. The China Ministry of Commerce stated that the EU’s move not only damages the legitimate rights and interests of China’s electric vehicle industry, but also disrupts and distorts the global automotive industry supply chain.

Iron Ore Key Indicators:

• Platts62 $105.15, +1.35, MTD $107.33. The sharp drop on metal sectors including copper and silver dragged down iron ore performance in general. However, iron ore became rather stronger than most of metals. The light trade yesterday was due to concerning on US CPI data impact. There could be more bottom hunting for cheaper seaborne iron ores in rest of the week. In addition, market rumors indicated an incoming China conference about refinancing of affordable housing, which potentially support the iron ore in short-run.

SGX Iron Ore 62% Futures& Options Open Interest (Jun 12th)

• Futures 114,696,600 tons(Increase 1,006,600 tons)

• Options 161,239,700 tons(Increase 710,700 tons)

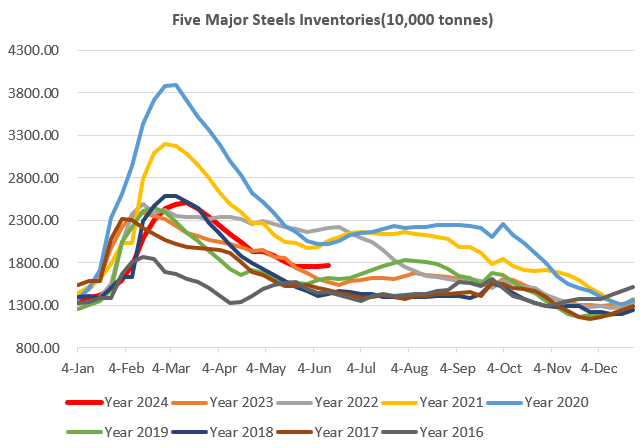

Steel Key Indicators:

• China Tangshan average billet cost at 3425 yuan/ton, down 13 yuan/ton on the week. Average loss at 55 yuan/ton.

Coal Indicators:

• JFE steel bought 80,000mt PLV German Creek coal for July loading at $254.