Market Verdict on Iron Ore:

• Neutral to bullish.

Macro

• China NBS:Chinese August PPI up 2.5% on the year, down 1.2% on the month. Chinese August CPI up 2.5% on the year, down 0.1% on the month. Chinese August M2 supply up 12.2% on the year, est. 12.2%, last 12%.

Iron Ore Key Indicators:

• Platts62 $101.95, -1.70, MTD $98.53. The structure curve was still believed at narrow area since the medium over last 12 months was $0.57 for the next months and the following month contract, i.e. Oct22-Nov22. However the spread currently was relatively low. PBF and NMHG regained popularity, with significantly improved volume in late half of August and discount/premium. India has indicated several times about removing the iron ore or pellets tariffs. Chinese steel mills increased restock sentiments because of the following Gold weeks and the National Congress would take over half month in October, in addition some northern cities would start environment related maintenance from late September.

SGX Iron Ore 62% Futures& Options Open Interest (Sep 9th)

• Futures 99,646,800 tons(Increase 1,536,100 tons)

• Options 85,748,600 tons(Increase 2,112,500 tons)

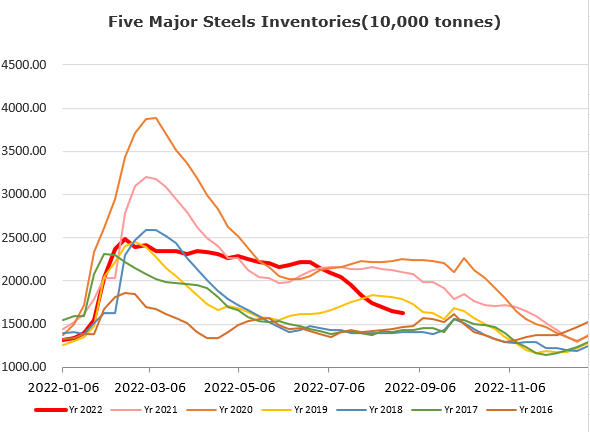

Steel Key Indicators

• 40 independent EAFs average cost 4223 yuan/ton, up 39 yuan/ton. Average loss at 182 yuan/ton.

• Chinese sample steel mills inventory 97.14 million tons, down 259,000 tons on the week.

Coal Indicators

• Australia FOB coking market was flat over the past two and half weeks. The trade range was from $270-273.5. Chinese CFR market saw a huge spike by $21.5 last Thursday, after seeing a bid for Oak Grove caroges from U.S. for October laycans PMV. However market has mixed-outlook on the Oak Grove coking coal, since hearing Canadian sourced PMV was offered only at $280 for August laycan. The CFR China index was marked down to $295 as the bid was $35 than the initial offer.