Verdict:

• Short-run Neutral.

Macro:

• BOE indicated that the inflation target of 2% was approachable in two years.

• OPEC monthly report indicated that the crude oil shortage reached 3 million barrels/day due to the extension production cut by Saudi Arab.

Iron Ore Key Indicators:

• Platts62 $122.60, +1.95, MTD $119.21. Although the primary market of seaborne iron ore was quiet last week, the secondary market maintained active. The current China domestic iron ore became more cost-effective to seaborne.

SGX Iron Ore 62% Futures& Options Open Interest (Sep 12th)

• Futures 120,919,900 tons(Increase 3,016,900 tons)

• Options 108,836,700 tons(Increase 2,353,800 tons)

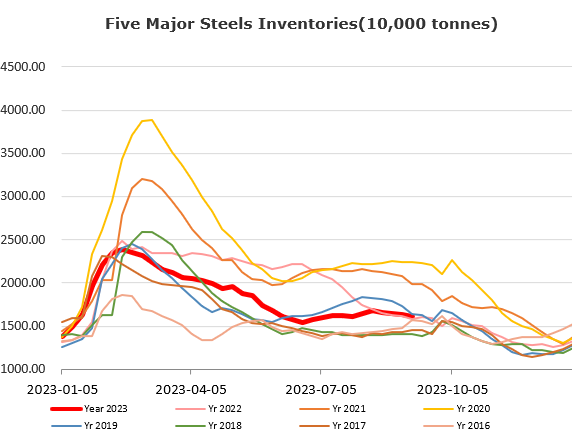

Steel Key Indicators:

• The Turkish HMS 1/ 2 80:20 scrap index maintained $377/mt yesterday, while market expect mills to resist fast climbing material price squeezed margins out. The Index rebounded almost 8% from the beginning of August.

Coal Indicators:

• The FOB Australia market gained popularity in Aisa market, as the bid went higher. The FOB Australia and CFR China spread went to high level at $23, while most of times the spread level should lie in – $20 to +$20 area. Traders saw the wide spread unsustainable in mid-run.