Market Verdict on Iron Ore:

· Neutral.

Macro

· IMF decreased the global economy growth expectation and sent warning on stagflation. The global economy growth rate in July report decreased from 6% to 5.9% in the year 2021. The growth rate in the year 2022 expected at 4.9%.

Iron Ore Key Indicators:

· Platts62 $128.50, -8.45, MTD $122.34.

· MySteel China 45 ports iron ore arrivals at 24.56 million tonnes, up 286,000 tonnes w-o-w. China six northern ports arrivals at 13.58 million tonnes, up 2.71 million tonnes w-o-w.

· MySteel Brazil and Australia iron ore delivery at 24.13 million tonnes, down 3.32 million tonnes w-o-w. Australia delivery 17.04 million tonnes, down 961,000 tonnes w-o-w. Brazil delivery 7.08 million tonnes, down 2.36 million tonnes w-o-w. Global iron ore delivery 30.03 million tonnes, down 5.496 million tonnes w-o-w.

· China Jan – Sep iron ore and its concentrates down 3% to 842 million tonnes.

SGX Iron Ore 62% Futures& Options Open Interest (Oct 12th)

· Futures 67,986,800 tonnes(Increase 509,000 tonnes)

· Options 82,956,500 tonnes(Increase 562,500 tonnes)

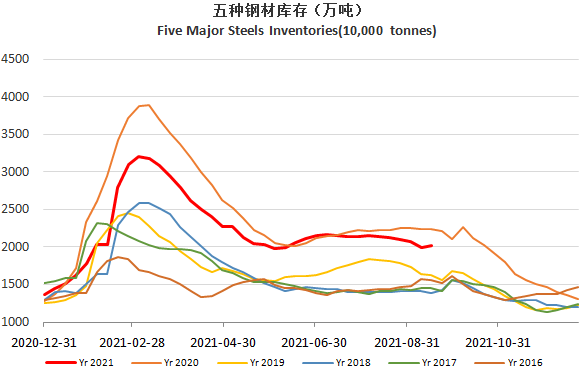

Steel Key Indicators

· Guangdong and Guangxi, China southern provinces started to loose restrictions on electricity consumption. Thus EAFs steel production recovered significantly. Jiangsu province also saw many steel mills recover production.

Coal Indicators

· China PM Li Keqiang held video conference with Mongolia PM Luvsannamsrai Oyun-Erdene. The conference sent a positive signals to increase the coal trades between the two countries.

· Shanxi Province prompted actions in coal mines restart operation after the flood damage. Most coal mines successfully start operating over the current two days.

· China Energy Bureau: Jan -Sep China total electricity consumption reached 6.17 trillion KWH, up 12.9% y-o-y.